Scale Quickly in Greater Phoenix

Manufacturers around the world are experiencing increasing challenges amidst rapid industry shifts in automation and globalization, changing day-to-day operations. While managing supply chain challenges, implementing operational efficiencies, and expanding technology, it’s critical to situate your business in a location that positions and supports your growth. Along with competitive operating costs, Greater Phoenix is home to the second-largest labor pool in the western U.S. and has one of the largest manufacturing supply chain ecosystems. The region is well-positioned to absorb both new-to-market manufacturers and the expansion of existing manufacturing companies.

Advanced Manufacturing

Get our 24-page, in-depth report on the advanced manufacturing ecosystem in Greater Phoenix.

Reliable Infrastructure

Greater Phoenix has the second-most reliable power grid in the nation and boasts access to more than 33 million people in seven states within a one-day truck haul, including major seaports in Los Angeles and Long Beach. Firms have access to nearly the entire southwest within a two-day haul.

Robust Workforce & Talent Pipeline

Key Colleges and Programs

Arizona State University (ASU), Northern Arizona University (NAU) and University of Arizona (UArizona) each have a full range of engineering, engineering technology/technician and general production/industrial-related programs. Examples of production programs include aerospace engineering, computer engineering, electrical and electronics engineering, mechanical engineering, industrial technology/technician, machine tool technology/machinist, welding technology/welder and others. ASU has top-ranked engineering and technology programs, with its Fulton School of Engineering undergraduate program ranking in the top 20% of ranked programs by U.S. News & World Report. The engineering school provides over 16,000 students per year with advanced knowledge on challenges in energy, health, sustainability, education and security.

Mature Talent & Workforce Pipeline

Education is critical not only for companies trying to meet today’s demands but also for preparing tomorrow’s workforce to excel in a dynamic manufacturing environment. Arizona has an extremely competitive workforce in regards to training, quality and availability of workers while maintaining one of the lowest costs for labor in the nation. ASU, Grand Canyon University, Maricopa Community Colleges, NAU, UArizona and the University of Phoenix are among the more than 40 universities and other institutions of higher learning that prepare the region’s workforce.

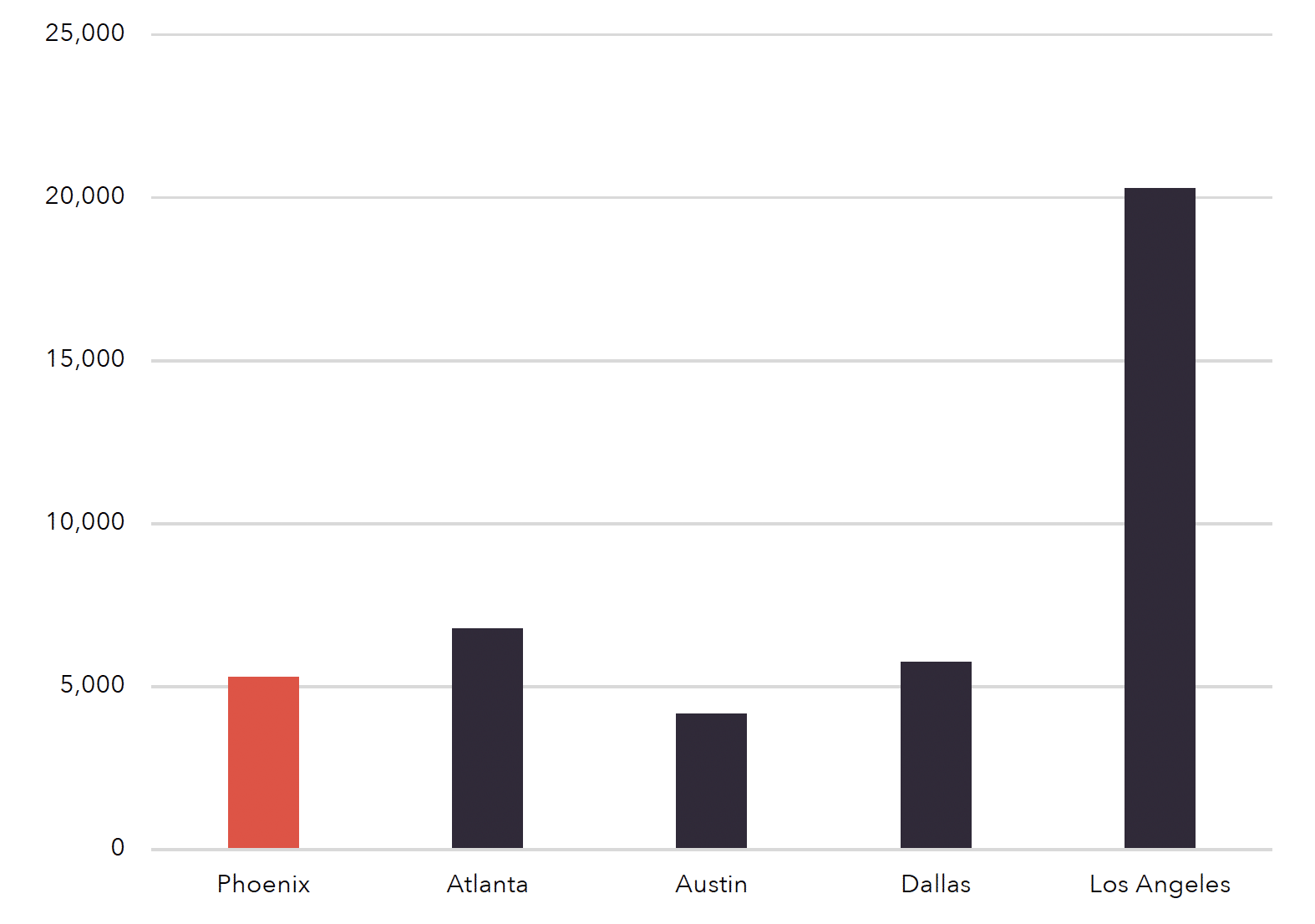

2021 Graduates by Region

Non-distance program completions in fields related to advanced manufacturing

Source: Lightcast 2023 Q2 Dataset

| Certificates | Associates | Bachelor | Master | Doctor |

|---|---|---|---|---|

372 |

492 |

2,632 |

1,555 |

229 |

Download the full industry analysis for more incentives and program details.

Reliable Infrastructure

Reliable Power

Arizona has the second-most reliable power grid in the nation and 73% fewer natural disasters than the adjacent state of California. Over the last 10-year period, Arizona recorded only 33 total hours of disturbances. Reduce risk and increase operating efficiency moving to Greater Phoenix.

Source: U.S. News & World Report

Intentional Water Planning

Thanks to smart water planning over the past century that included the 1980 Groundwater Management Act, Arizona has a 100-year assured water supply and a superior water system compared to its peer states in the southwest. Get more information here.

Airline Connectivity & Market Access

Ideally situated within the southwestern United States, Greater Phoenix serves as a direct carrier to and from consumers in the U.S. and Mexico. Companies have access to more than 33 million people across seven states within a one-day truck haul, including major seaports in Los Angeles and Long Beach. Phoenix Sky Harbor offers about 1,200 daily domestic and international flights and handles over 800 tons of cargo each day.

Regional Rail Access

Greater Phoenix is served by two major railroads, Union Pacific and BNSF. With major rail lines throughout the entire southwest reaching Greater Phoenix, manufacturers can rely on these railroad systems for both the import and export of goods and materials.

Download the full industry analysis for additional details on Greater Phoenix infrastructure.

Competitive Operating Costs

Greater Phoenix Operating Environment

The state offers a minimalist regulatory approach, no corporate franchise tax and is constitutionally recognized as a right-to-work state. From aggressive tax credits and incentives to programs designed to increase access to capital, the region offers direct access to Arizona’s robust, pro-business climate. Greater Phoenix provides the right combination of affordability, size and scalability, making it the perfect choice for new-to-market and growing manufacturers.

Comparative Operating Advantages

- Minimal regulation

- Right-to-work state

- Low unionization

- 90 days or less permitting, guaranteed

- Low worker’s compensation and unemployment

- Foreign Trade Zone (AZ Property Tax Benefit)

- Military Reuse Zone

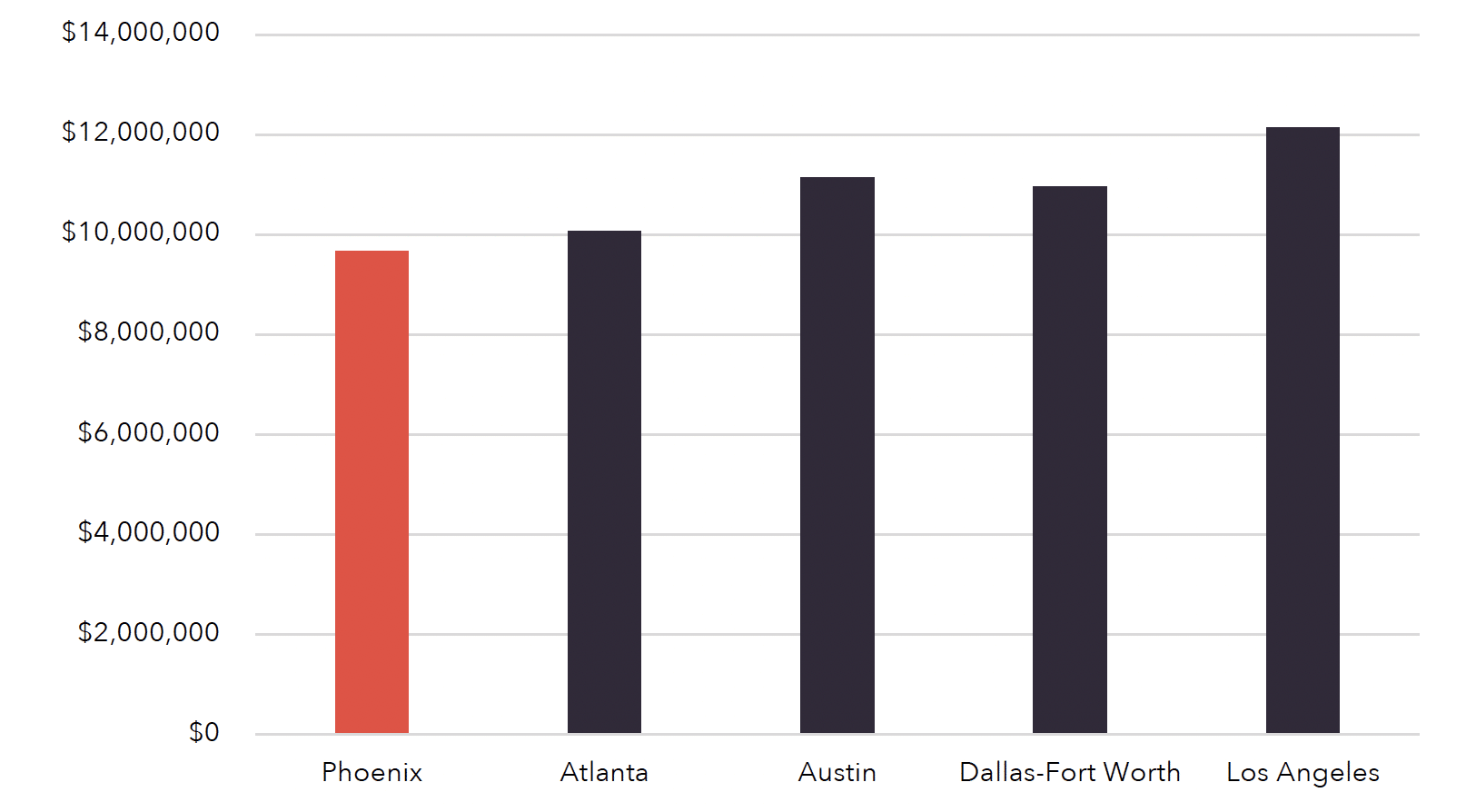

Total Operating Cost by Metro

Operating costs for typical advanced manufacturing firm

Assumptions: $30,000,000 personal property investment; 75,000 square foot Industrial Manufacturing, Lease; Utilities (per month): Electricity: 75KW, 30,000KWh; Water/Wastewater: 3,000cf, 5/8meter; 100 jobs (Bureau of Labor Statistics equivalent occupations)

Source: Applied Economics MetrocompTool, June 2023

Calculate Your Real Estate Savings

Select your MSA, building type and square footage to see how much you would save on annual real estate costs in Greater Phoenix.

Type

Sq. Feet

Calculations were performed using annual lease rates per square foot, effective property tax rates, and average costs of water, wastewater, electric and natural gas; utilities are included in office lease rates.

Sources: GPEC Metrocomp Tool; Costar Market Reports 2022

Established Supply Chain

Major Manufacturers in Greater Phoenix

Greater Phoenix is a leader in the Mountain West for manufacturing operations. The region is home to some of the nation’s largest manufacturers. With more than 1,600 advanced manufacturing companies calling Arizona home, the region boasts an environment for sustained success. The companies below represent a sample of the firms currently operating in the region.

Recent Locates and Expansions to Greater Phoenix

Companies around the country and world have responded to Greater Phoenix’s growth in the advanced manufacturing space. From 2009-2019, 238 companies relocated or expanded to the region, and it has been happening at an increasing rate, with 38% of the companies moving in 2018 or 2019. Some of the major movers in recent years include:

Download the full industry analysis for a more comprehensive list of local suppliers and innovators in the region.

Supportive Policies

Qualified Facilities Refundable Tax Credit

The Qualified Facilities Refundable Tax Credit targets manufacturing facilities, including those focusing on research and development or headquarters locations. It offers a refundable income tax credit equal to the lesser of:

- 10% of the qualifying capital investment

- $20,000 per net new full-time employment position at the facility

- $30,000,000 per taxpayer

Military Reuse Zones (MRZ)

MRZ was established in 1992 to minimize the impact of military base closures, both Arizona-designated MRZs are in Greater Phoenix: Phoenix-Mesa Gateway and Goodyear Airports. Businesses located in MRZs are subject to Transaction Privilege Tax Exemption and Property Reclassification.

CHIPS and Science Act

After massive commitments from Intel and Taiwan Semiconductor Manufacturing Company (TSMC) in the last two years, Arizona is positioned to become a national hub for the semiconductor industry. Suppliers are flocking to the region to support the industrial giants. Related companies currently operating in or considering expansion to Arizona and Greater Phoenix can take advantage of the CHIPS Act to further grow in the local operating environment.

Click here to see how Greater Phoenix can support your CHIPS Act planning.

HB2822: Tax Reduction to Benefit Advanced Manufacturers

HB2822 changes the depreciation schedule by setting the full cash value of business and agricultural personal property to 2.5% of the property’s acquisition cost, thereby lowering the assessed value of the property to create a reduction in taxes. Over a 10-year period, the personal property tax on a $500 million property would be just $2.4 million, a fraction of the nearly $51 million tax on standard depreciation.

Below is a table comparing deprecation value of the property before and after the passage of the bill. Get more information here.

| Schedule | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 | Year 9 | Year 10 |

|---|---|---|---|---|---|---|---|---|---|---|

Previous (Pre-2022) |

22.5% |

35.7% |

45.0% |

51.1% |

53.4% |

47.0% |

36.0% |

24.0% |

12.0% |

2.5% |

Current (Since 2022) |

2.5% |

2.5% |

2.5% |

2.5% |

2.5% |

2.5% |

2.5% |

2.5% |

2.5% |

2.5% |

35M

More than 35 million consumers can be served within a single day’s truck haul

36%

Greater Phoenix offers operational costs up to 36% lower than California

75%

Shipping costs to California are up to 75% cheaper than other Mountain West markets

Download the full industry analysis for more details on incentives, programs and HB2822.

High Quality of Life

Experience a vibrant lifestyle and diverse culture at an affordable cost of living.

Enjoy the outdoors with more than 300 days of sunshine, average temperatures of 75 degrees, convenient access to over 400 hiking trails, and globally recognized sporting events. Take part in a vibrant arts and culture scene that includes prominent classical arts to public art to craft markets and a diverse range of music and cultural events. And, eat well with fresh farmers markets in every city, and globally recognized chefs and culinary experiences at your doorstep. Click the icons below to learn more about Greater Phoenix living.