Industry Outlook Report

May 2025

Greater Phoenix is at a strategic inflection point, with entrepreneurship climbing at impressive rates, startup funding surging in recent years, and an unprecedented wave of advanced manufacturing and software innovation investment paving the way for new opportunities and further growth.

The region’s business-friendly environment, competitive operating costs, and streamlined regulatory framework have made it a destination for entrepreneurs over the last few decades, with momentum only climbing — new business creation in the region and across the state grew by over 8% year-over-year in 2023.

8%

YoY Increase in New Business Formations1

#7

U.S. Metro with the Most Startups2

$1.2B

Total Investments in 20243

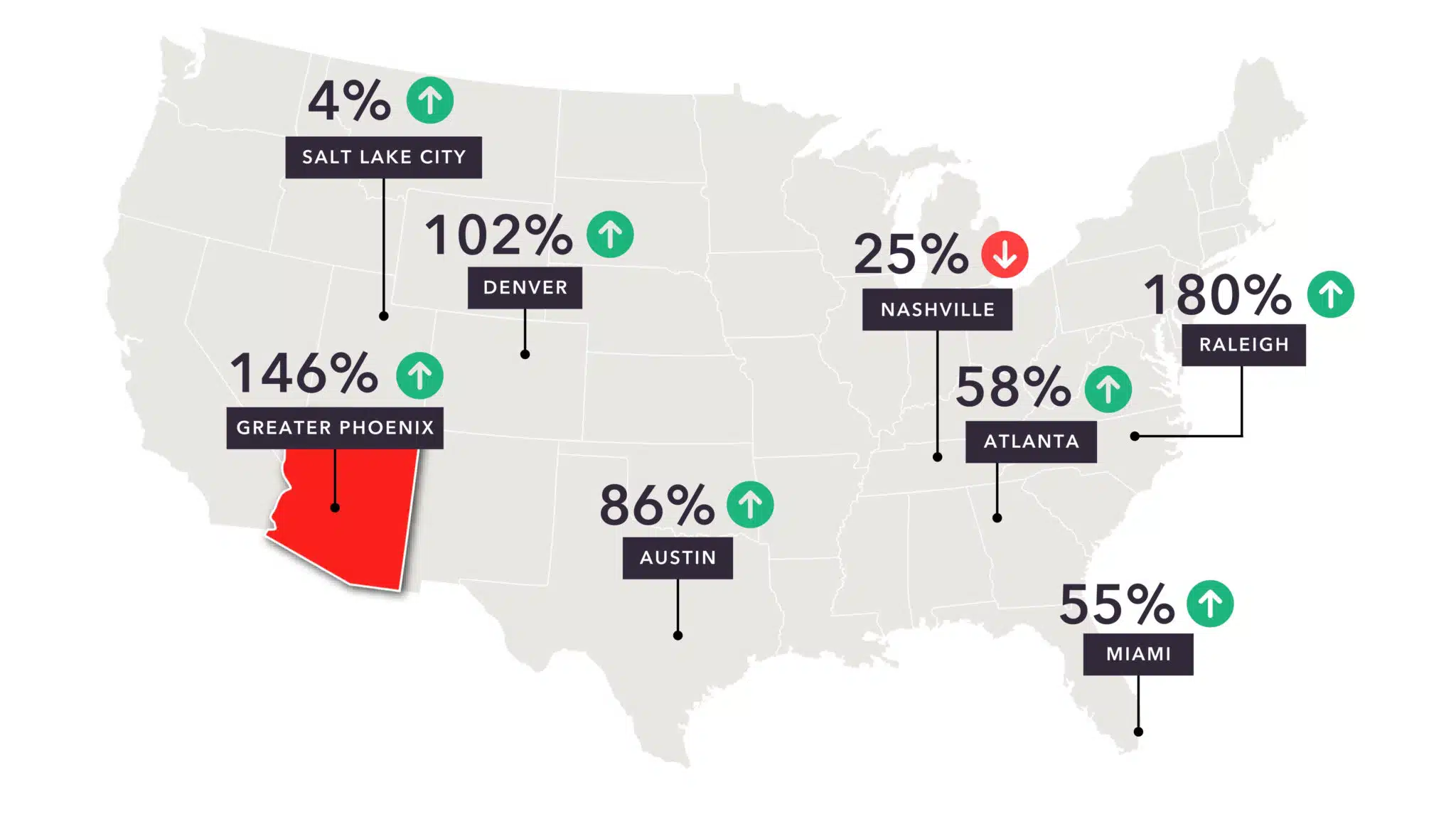

VC Funding Investments Change, 2014–2024

According to PitchBook, Greater Phoenix has experienced a surge in venture capital (VC) funding in recent years. The region has exceeded the $1-billion VC threshold for seven consecutive years, a feat it had never achieved prior to 2018. There was a 146% increase in investments from 2014 to 2024, ranking second only to Raleigh (180%) and well above peer markets including Atlanta (58%), Salt Lake City (4%) and Austin (86%).

Seed-stage funding under $5 million remains scarce, and founder and VC density is spread across the sprawling metro. By leveraging growing investments in advanced industries like software, semiconductors, aerospace and climate tech, Greater Phoenix has a pivotal opportunity to accelerate lab-to-market pathways, thereby positioning the region to leapfrog mid-tier competitors within five years due to a convergence of strategic assets and emerging momentum. Doubling the annual seed and Series A deal count, and converting the chip manufacturing boom into a flywheel of venture-backed companies would generate compounding momentum. Early successes would then attract more talent, capital, and startups, thus reinforcing the region’s position as a high-growth innovation hub.

Key Ecosystem Characteristics in Dynamic Tech Markets

A healthy startup ecosystem has interconnected elements that drive innovation and growth. At its core, the ecosystem thrives on funding and capital allocators, enabling startups to secure financial resources. Research and development, along with academic initiatives, fuel innovation, while tech brand alignment fosters partnerships with established companies. Greater Phoenix’s innovation engine is reinforced by a robust annual STEM pipeline of 36,619 undergraduates from the three public universities present in the state as of 2023.

Universities across Arizona are playing a pivotal role in advancing regional innovation. Arizona State University, through initiatives like its partnership with Mayo Clinic on the MedTech Accelerator, the J. Orin Edson Entrepreneurship + Innovation Institute, and Idealab Arizona, has helped catalyze entrepreneurial activity. Grand Canyon University, University of Phoenix and Maricopa County Community Colleges also give students the opportunity to see their entrepreneurial ideas come to life or support other ventures with their degree-related skills through university programs, tech transfers and angel initiatives. Meanwhile, the University of Arizona continues to be a leader in entrepreneurship education and commercialization through the McGuire Center for Entrepreneurship. Together, these institutions are fostering the next generation of founders and embedding innovation into the region.

Critical infrastructure is further supported, and mentorship is provided through incubators, accelerators, venture studios, and co-working spaces. State incentive programs and pitch competitions further encourage entrepreneurship, while tech trade and nongovernmental organizations, alongside a broad network of support programs, provide a robust network. Key resources have continued to expand, with new programs and organizations launched in the last few years, including Freeway, PHX FWD, Plug and Play, Tesoro.vc and XLR8 Health Tech. These components work together to create a dynamic and self-sustaining ecosystem that fosters regional success.

While the region has seen significant momentum in advanced manufacturing and a surging tech talent pipeline, it remains an underpowered venture capital ecosystem, particularly at the early stage. Despite an increase in fund formations, the region has too few institutional seed and Series A investors based locally, and startups often rely on coastal funds with limited regional presence or participation. Angel networks do not always display the coordination and velocity seen in cities like Salt Lake City or Raleigh. The current density of the founder-investor network, combined with limited national press visibility, creates a perception gap: Greater Phoenix is often overlooked as a startup hub despite its real economic assets. Bridging this gap will require a strategic infusion of capital, narrative-building, and physical clustering, particularly around emerging strengths in semiconductors, climate tech, and digital health.

Current Greater Phoenix VC Funding Trends & Emerging Opportunities

While Greater Phoenix trails competitor markets, it stands out positively amid a broader decline in VC funding nationally. Recent VC investments have built on significant growth in Arizona’s startup ecosystem for more than a decade. The number of deals declined by 21% from 2014 but investment grew by approximately 143% from 2014 to 2024, according to recent data from PitchBook, thus showcasing the enthusiasm of investors and entrepreneurs to invest in this space. According to the U.S. Census Bureau, Greater Phoenix currently ranks seventh among U.S. cities with the most startups. While the state is experiencing growth in Series B and C rounds, early-stage capital remains largely sourced from out-of-state investors, due in part to a limited number of VC firms headquartered locally. This later-stage funding signals increasing investor confidence in Arizona startups’ ability to scale successfully. From early-stage ventures testing a product to late-stage startups looking to expand, the region is home to startups at all stages.

PitchBook’s VC Ecosystem Rankings compare global cities based on the size and maturity of their startup networks. Greater Phoenix currently ranks 65th among the world’s top startup cities in comparison to global rankings for overall development and growth rates relative to one another. The framework provides a scoring system for development and growth by assessing the size, maturity, and growth rates of a VC ecosystem. Greater Phoenix ranks closely among Charlotte, Nashville, Salt Lake City and Raleigh.

Between 2020 and 2024, PitchBook data reported that venture capital funding in Greater Phoenix totaled $7.6 billion out of the $1.2 trillion nationally during those years. In 2024, Greater Phoenix alone garnered $1.2 billion in venture capital funding, with more than 140 deals having reached completion within the calendar year.

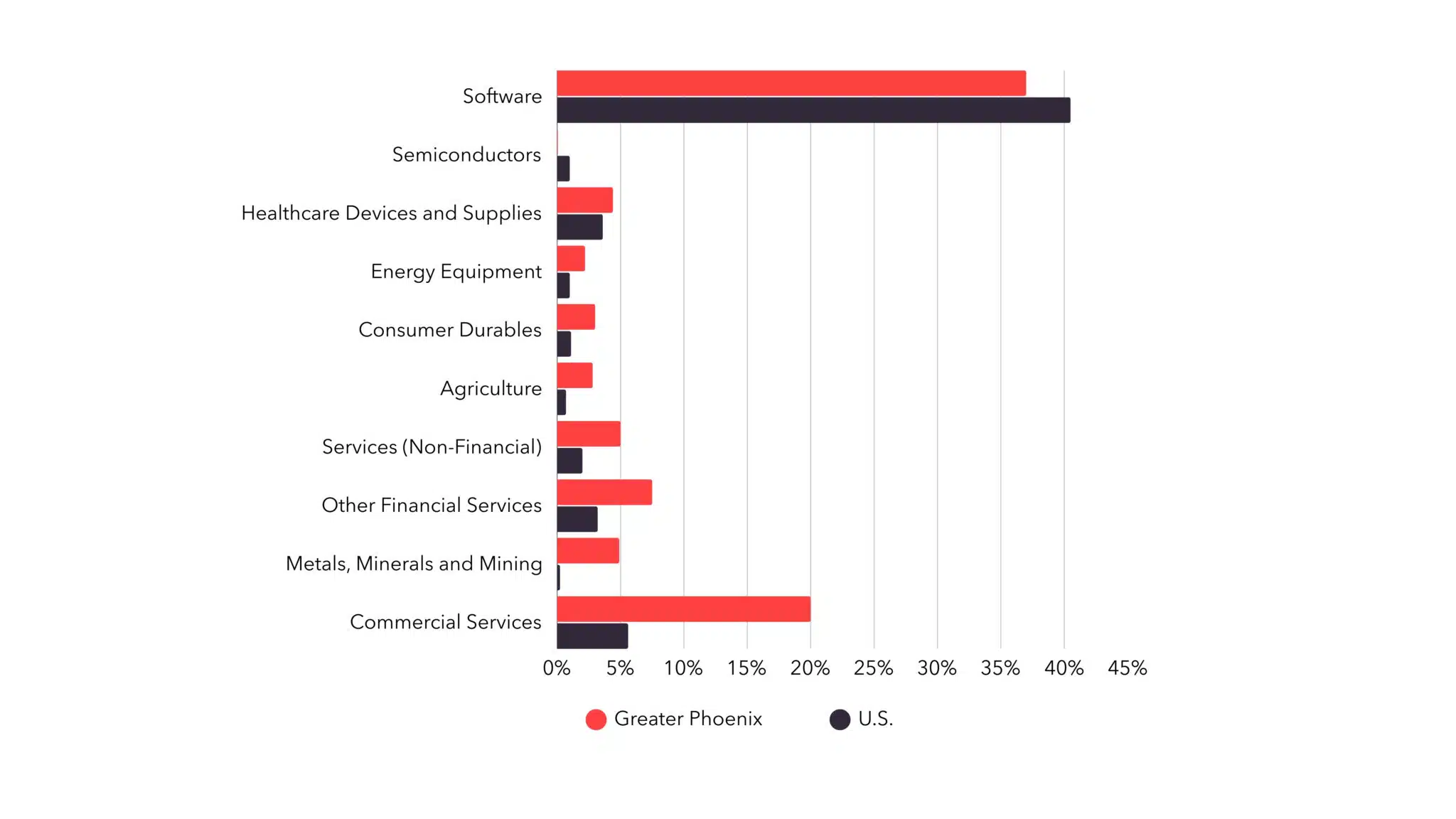

Greater Phoenix’s venture capital investment between 2020 and 2024 was highly concentrated in commercial services, far exceeding U.S. levels. The region also invested more in other financial services and non-financial services compared to the U.S. While Greater Phoenix skewed lower in healthcare devices and supplies, energy equipment, and metals and mining, VC investment still outpaced or matched national levels. Ultimately, U.S. investments are more broadly diversified across industries in comparison to the regional concentrations, as seen in the chart below.

Arizona’s established semiconductor industry, anchored by Intel and Taiwan Semiconductor Manufacturing Co. (TSMC)’s recent expansions, has created opportunities for startups in advanced materials, chip design, and hardware innovation. While the region continues to attract attention for significant investment in both software and semiconductors, VC investment in those particular industries did not outpace national levels.

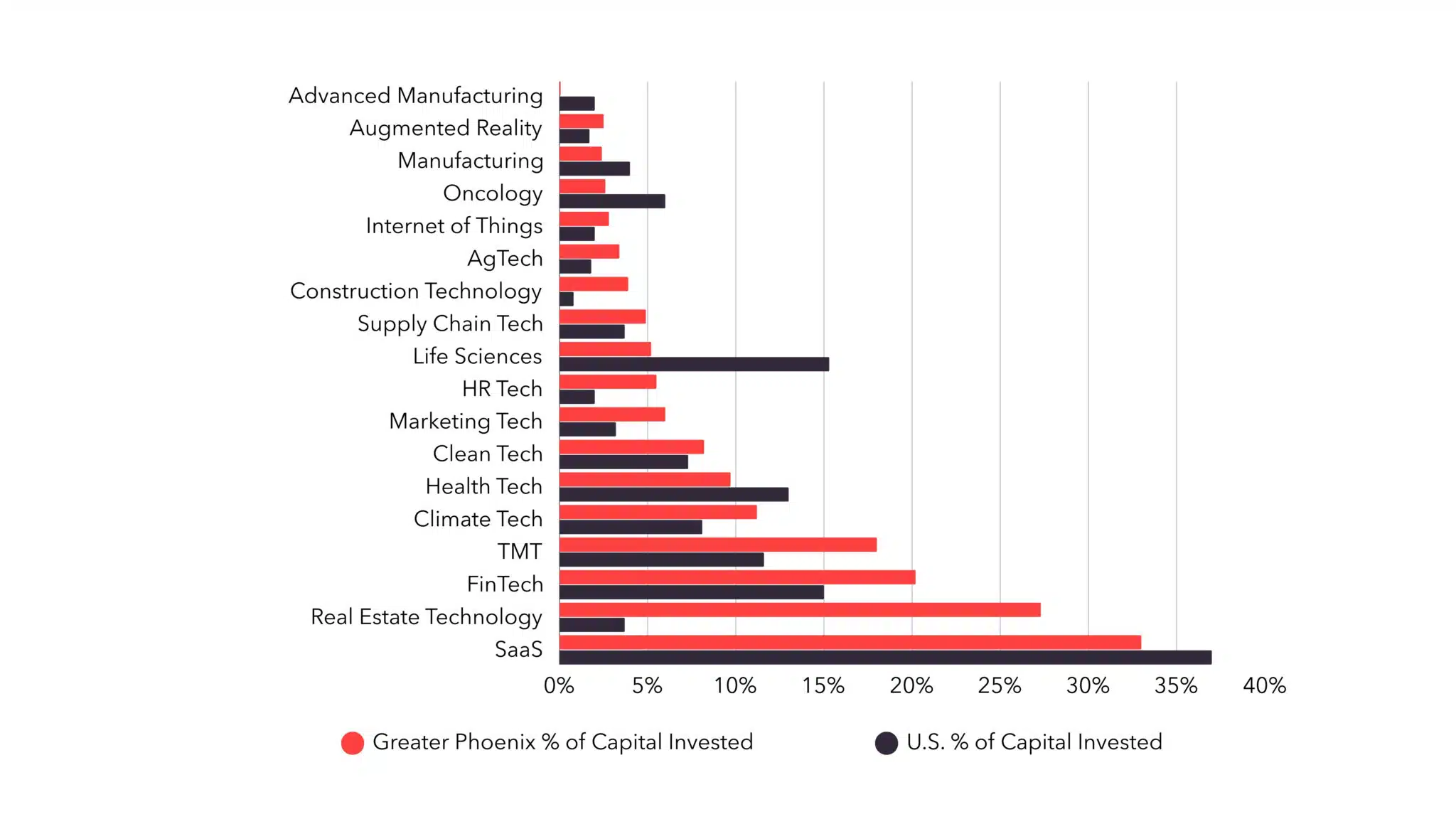

Funding specialties broken down by industry verticals in PitchBook illustrate that Greater Phoenix’s VC investment dominated in sectors such as real estate technology, fintech and climate tech. While Greater Phoenix garners strong investment in key verticals like advanced manufacturing and health tech, its increasingly diverse startup ecosystem — spanning SaaS, biotech, and clean tech — positions the region to build a more resilient and inclusive path to becoming a top-tier national innovation hub. The region is rapidly transforming into a national center of advanced industry, where semiconductors, aerospace, climate tech and digital innovation converge with a growing startup ecosystem.

VC Investment Percent of Capital Across Industry Groups

Source: PitchBook, 2020-2024

Funding Specialties by Industry Vertical

Source: PitchBook, 2020-2024

Strategic Recommendations to Become a Top-Tier Tech Hub

To further elevate Greater Phoenix into the top tier of U.S. innovation ecosystems, regional leaders must intentionally link capital, talent, infrastructure, policy, and storytelling into a cohesive unit. To solidify the region’s trajectory as a top-tier tech hub, we must accelerate the development of the software startup ecosystem. Initiatives like PHX FWD are laying the groundwork by supporting founder capacity, improving access to early-stage capital, and building a connected entrepreneurial network. When paired with efforts from local funds like AZ-VC, PHX Ventures and Monsoon Ventures, Greater Phoenix is expanding venture capital access and increasingly positioned to lead in software innovation. Supporting this sector is not just complementary to our strengths in hardware — it is vital to our evolution as a dynamic, well-rounded tech hub.

Greater Phoenix is entering a defining moment, fueled by record-setting investment in advanced manufacturing and innovation. Intel’s $32 billion Ocotillo expansion and TSMC’s concurrent $65 billion three-fab campus (recently expanded to a planned $165 billion total U.S. outlay) have catapulted Arizona onto the short list of leading global semiconductor hubs. Furthermore, Amkor announced plans to build a $2-billion semiconductor advanced packaging manufacturing plant in Peoria. The OSAT facility will be the largest in the U.S., and will eventually be home to packaging and testing chips for Apple. Alongside historic investments in advanced manufacturing, Mayo Clinic recently announced a $1.9 billion expansion of its Phoenix campus to address the region’s rapid population growth and enhance infrastructure and technology for delivering high-quality care to patients with complex medical conditions. These historic investments signal more than industrial growth — they create a foundation for a new generation of startups to launch, deploy, and scale in-market. To fully harness this momentum, Greater Phoenix must now pair its industrial strength with intentional investments in high-growth software ventures. While semiconductors and advanced manufacturing will remain foundational to Arizona’s economy, the path to startup and scale in these sectors is often constrained by long timelines and significant capital requirements. In contrast, software presents an agile and scalable avenue for innovation-led growth.

This roadmap spans short-term, mid-term, and long-term catalytic action, all anchored by the region’s unique positioning in software, semiconductors, climate tech, and applied AI.

-

- Create a regional innovation council led by founders and industry leaders in collaboration with investors, universities, corporations, and state agencies to define Greater Phoenix’s top-tier sectors and coordinate messaging, ecosystem mapping, and flagship events.

- Continue to facilitate a proving grounds environment where startups can test, deploy and scale technologies in AI, battery, energy, quantum and more.

- Institutionalize collaboration between startup founders, startup support organizations, universities, and local government to streamline resources and eliminate duplication.

- Launch a talent incentive fund, targeted at high-skill tech roles to help startups compete with offers from other dynamic tech markets.

- Enhance national storytelling to position Greater Phoenix as an innovation hub, drawing awareness to current successes.

- Finally, increase both local and out-of-market capital through dedicated seed funding and incentives to bring coastal VCs into the ecosystem.

Conclusion

Overall, Greater Phoenix has the foundational assets to leapfrog mid-tier innovation markets: a world-class semiconductor cluster anchored by historic investments, a nationally recognized university engine in ASU, and a cost-efficient environment that continues to attract both talent and companies. The region also shows growing momentum in enterprise software and healthcare innovation, supported by a base of major employers and emerging startups in digital health, medtech and AI-driven solutions. Yet to fully realize its potential, the region must close two persistent gaps — seed-stage capital, and ecosystem density and division — while building a clear and unified narrative around its core strengths in semiconductors, climate tech, aerospace and applied AI. If these gaps are addressed with urgency and cohesion, Greater Phoenix could evolve into a globally competitive tech hub within the next decade.

Download the PDF on the Future of Startups & Entrepreneurship in Greater Phoenix.

Industry Expert

Mark Paratore

Vice President, Business Development

1. Annual Business Applications by State and County, U.S. Census Bureau, June 2024

2. U.S. Census Bureau, 2023

3. Pitchbook, 2024

Published: 05/20/2025