Build a Healthier Business in Greater Phoenix

Greater Phoenix has long been a destination for healthcare services because of its excellent quality of life and well-established healthcare providers. Today, a new innovative healthcare industry has emerged from the region’s legacy of care. Supported by outstanding educational partners and a talented growing workforce, top companies choose the region to develop new technologies to support healthy living.

Healthcare Innovation Industry Report

Get our 37-page, in-depth report on the healthcare innovation ecosystem in Greater Phoenix.

Large Collaborative Network

Healthcare Innovation Leaders

A long history of renowned operations with rapid growth today has positioned Greater Phoenix as a hub for industry advancement. With a thriving startup ecosystem, world-class universities and research centers, and sustained commitment to intentional growth, Greater Phoenix has laid the groundwork to be an innovative, forward-thinking healthcare destination.

$1.1B

Total capital raised 2020-24

Source: Pitchbook

47K+

New healthcare jobs 2018-23

Source: Lightcast 2024 Q3, Pitchbook

25%

Projected employment growth in healthcare & biomedical over the next decade, compared to 17% nationally.

Source: Lightcast 2024 Q3

Hospital Systems

Greater Phoenix boasts exemplary access to patient care and clinical trials with a deep network of local hospital systems that provide care, conduct clinical research and provide quality jobs. These leaders operating in the region include Banner Health, HonorHealth, Dignity Health, Mayo Clinic, Phoenix Children’s Hospital and Valleywise.

Startups and venture capital funding

Greater Phoenix is home to a growing number of startups developing cutting-edge solutions for a wide range of healthcare challenges, including telemedicine, health data analytics, patient engagement and wearable technology. The region is seeing significant development in medical device innovation and venture capital funding.

Local health tech startups include:

AI data collection

Hiring software

Dental staffing

Outpatient rehabilitation software

Greater Phoenix attracted $1.1 billion in capital investment for more than 140 healthcare-related companies from January 2020 through July 2024, playing a key role in developing the ecosystem built for medtech growth. In addition, National Institutes of Health (NIH) federal programs contributed $364 million across the state in 2023.

$45M Series B

$45M Series C

$75M Series A and B

$42M Series C

Exceptional Talent Pipeline

Connecting Education and Industry

Greater Phoenix attracts a skilled, diverse workforce fueled by globally recognized universities and community colleges. These schools offer programs related to healthcare delivery and informatics, health sciences, diagnostics, biomedical sciences and more.

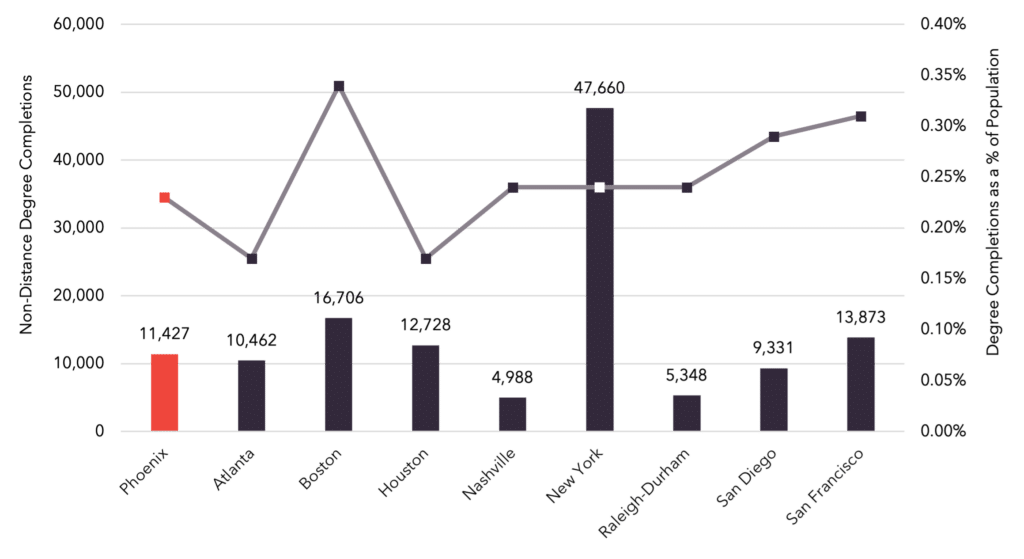

A myriad of institutions including Arizona State University (ASU), Creighton, Grand Canyon University (GCU), Maricopa County Community College District (MCCCD), Midwestern University, Northern Arizona University (NAU) and the University of Arizona (U of A) operate in the region. More than 11,000 students graduated in 2022, with a completion rate of STEM degrees twice the national average. The region’s talent pipeline from the non-distance college and university degrees in the healthcare and bioscience fields is comparable to peer markets like Atlanta, Raleigh-Durham, New York, Houston and San Diego.

Competitor Markets’ Talent Pipeline

Arizona State University

ASU fosters an environment to push the boundaries of medical science and healthcare delivery through its strategic initiatives, partnerships and programs. The university’s School of Life Sciences offers nine undergraduate programs and 20 graduate programs related to several types of biology, microbiology, molecular and cellular biology, neuroscience, and life sciences. The new ASU School of Medicine and Advanced Medical Engineering will integrate clinical medicine, biomedical science and engineering into its downtown Phoenix education.

University of Arizona and Northern Arizona University at Phoenix Bioscience Core

At the Phoenix Bioscience Core (PBC), a cluster of healthcare- and life sciences-focused entities in downtown Phoenix, both U of A and NAU have satellite campuses. The U of A College of Medicine offers graduate programs including Clinical Research MS, Clinical Translational Sciences MS and PhD, and Master of Arts in Bioethics, while NAU’s College of Health and Human Services offers degrees related to physical and occupational therapy.

Grand Canyon University

GCU, with more than 25,000 on-campus students in Phoenix, uses real-life healthcare experiences to teach students modern concepts of the industry. Its offerings include biology and health sciences bachelor programs, degrees in health informations and leadership and management, and Master’s programs in healthcare administration.

Other Educational Institutions and Satellite Campuses

Programming offered by local universities is supplemented by other satellite campuses and educational institutions around the region.

Creighton University’s 195,000 square-foot medical campus in Phoenix is a four-year program providing access for students and medical residents. In Glendale, Midwestern University specializes in the education of dental medicine, health science, osteopathic medicine, optometry, pharmacy, pediatric and veterinary medicine. AT Still School of Osteopathic Medicine in Mesa is the anchor of the Arizona Health & Technology Park, while in Scottsdale, Mayo Clinic’s Alix School of Medicine offers dual degree programs in healthcare delivery, health informatics and biomedical diagnosis in partnership with ASU. MCCCD, with 10 campuses across Greater Phoenix, offers bachelor’s and associates degrees in a variety of medical fields.

Download the full industry analysis to learn more about the healthcare innovation industry.

Research and Development

Regional centers of innovation and excellence

Greater Phoenix private and public leaders are dedicated to the research and development of healthcare innovation that will make up the future of the industry. The partnerships have helped the region receive multiple health-care related grants from the Economic Development Administration (EDA) and establish a base for progress and discovery.

Below are examples of major employers who focus on discovery and treatment.

Arizona’s largest public employer, specializing in diagnostics, prevention and treatment of major diseases.

Routinely ranked as a top hospital for neurological surgery and neurosurgery.

Home to award-winning research centers and offers more than 1,000 active clinical trials.

A multi-pronged early-phase clinical research and care facility, deploying new drug and medical device innovations.

Explore centers, accelerators and educational programs that help shape the innovation in Greater Phoenix.

Center for Entrepreneurial Innovation

Center for Entrepreneurial Innovation’s (CEI) business incubation program offers offices, labs, and ongoing support to high-growth startups with specializations in tech, medical devices and bio-science.

Photo: Gateway Community College

ASU-Mayo MedTech Accelerator

The MedTech Accelerator, a collaboration between renowned healthcare provider and research institute Mayo Clinic and the largest public school the nation, ASU, aims to improve the science science of health care delivery and practice while advancing patient care.

Photo: ReSuture

WearTech Applied Research Center

The WearTech Center, part of the Partnerhsip for Economic Innovation, works to test and validate lab research, prototype next-generation devices and conduct FDA trials in-house.

Photo: ASU

Phoenix Bioscience Core (PBC)

The highest concentration of research scientists and complementary research professionals in the region is in downtown Phoenix at the Phoenix Bioscience Core. Firms and researchers have opportunities to operate and scale at PBC, currently developed to 1.5 million square feet with plans to grow to more than 6 million square feet of biomedical-related research, academic and clinical facilities.

Twenty-six different entities operate at PBC, including CEI, Dignity Health, TGen, Wexford Science + Technology and ASU’s recently announced School of Medicine and Advanced Medical Engineering.

Robust Workforce

Healthcare Workforce in Greater Phoenix

Greater Phoenix offers a skilled, diverse workforce that is continuously fueled by globally recognized universities and community colleges. The talent pool, which grew by a third from 2018-23, is expected to add more than 70,000 healthcare innovation and bioscience jobs in the next decade — more than regions including Atlanta, Minneapolis, Nashville, Raleigh-Durham, San Diego and Seattle. Below is a sample of occupations compared across major metros.

Source: Lightcast 2024 Q3 Dataset

Download the use case document for the full workforce overview.

| Occupation | Phoenix | Atlanta | Boston | Houston | Nashville | New York | Raleigh-Durham | San Diego | San Francisco |

|---|---|---|---|---|---|---|---|---|---|

Registered Nurses |

47,867 |

53,821 |

67,607 |

64,261 |

23,407 |

188,919 |

28,529 |

25,451 |

41,785 |

Medical Assistants |

16,212 |

14,883 |

12,452 |

16,350 |

5,494 |

45,206 |

5,339 |

10,160 |

14,852 |

Medical Secretaries and Administrative Assistants |

13,251 |

6,311 |

15,459 |

14,248 |

6,065 |

29,325 |

6,763 |

11,087 |

13,762 |

Nursing Assistants |

11,101 |

22,678 |

27,499 |

19,335 |

6,806 |

83,540 |

11,479 |

10,492 |

11,946 |

Medical and Health Services Managers |

7,749 |

4,881 |

14,636 |

12,077 |

5,284 |

31,738 |

3,998 |

5,434 |

9,401 |

Clinical Laboratory Technologists and Technicians |

6,908 |

6,459 |

9,929 |

8,190 |

3,220 |

19,734 |

3,909 |

2,966 |

4,724 |

Radiologic Technologists and Technicians |

3,834 |

3,522 |

4,044 |

4,813 |

1,393 |

14,036 |

1,750 |

1,517 |

2,332 |

Physicians, All Other |

3,649 |

4,361 |

7,158 |

7,525 |

2,184 |

15,326 |

3,939 |

3,667 |

4,711 |

% Change (2018-2023) |

33.4% |

19.2% |

6.8% |

33.4% |

29.4% |

5.9% |

17.6% |

6.4% |

6.3% |

67%

STEM completion growth in Greater Phoenix from 2012-22

Source: Lightcast 2024 Q1 Dataset

29745

Total Banner Health Employees

Source: MAG 2022 Employer Database

#3

Medical Equipment and Supplies Manufacturing Jobs Added (2018-2023)

Source: Lightcast 2024 Q3 Dataset

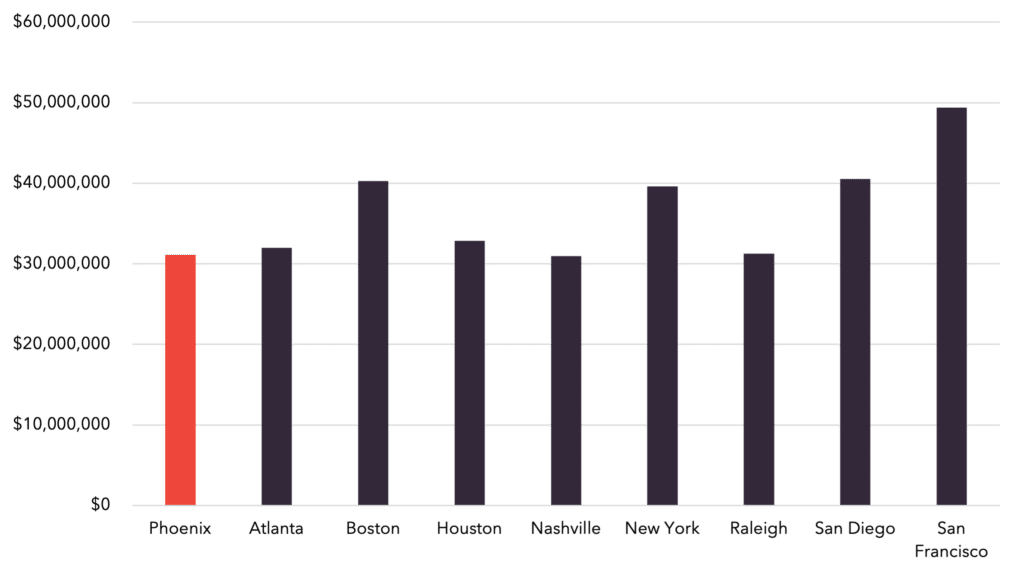

Competitive Operating Costs

Companies in Greater Phoenix enjoy the benefits of low business costs and a minimalist regulatory approach. With housing and workforce costs lower than competitor markets, companies grow and scale in a vibrant operating environment.

Photo: ASU

Annual Business Operating Cost Comparison

The annual business operating cost pro-forma below estimates healthcare manufacturing facilities operating costs in competitor markets across a handful of major expense categories. Component and custom analyses to match your company’s operations can be provided upon request. Contact us to request a custom analysis for your business.

Healthcare manufacturing facilities market comparison

Metro

Employee Payroll

Fringe and Mandated Benefits

Utilities

Real Estate Payments

Property Tax

Total Operating Cost

Index

Phoenix

$22,705,800

$5,181,732

$506,759

$2,700,000

$11,496

$31,105,787

100.0%

Atlanta

$23,352,714

$5,508,269

$549,110

$2,152,500

$399,700

$31,962,293

102.8%

Boston

$27,468,811

$6,417,355

$2,415,733

$3,362,500

$617,000

$40,281,399

129.5%

Houston

$24,251,386

$5,559,841

$683,379

$1,800,000

$566,215

$32,860,821

105.6%

Nashville

$22,863,721

$5,243,514

$715,932

$1,910,000

$244,050

$30,977,217

99.6%

New York

$27,422,393

$6,758,897

$1,064,192

$4,370,000

$0

$39,615,482

127.4%

Raleigh

$22,760,108

$5,339,925

$481,197

$2,400,000

$253,125

$31,234,355

100.4%

San Diego

$26,544,121

$7,608,153

$1,903,601

$4,170,000

$293,500

$40,519,375

130.3%

San Francisco

$31,578,620

$9,041,354

$1,328,897

$6,990,000

$465,000

$49,403,871

158.8%

Source: Applied Economics Metrocomp Tool, January 2024

Quality of Life

Experience a vibrant lifestyle and diverse culture at an affordable cost of living

Enjoy the outdoors with more than 300 days of sunshine, average temperatures of 75 degrees, convenient access to over 400 hiking trails and globally recognized sporting events. Take part in a vibrant arts and culture scene that includes prominent classical arts to public art to craft markets and a diverse range of music and cultural events. And, eat well with fresh farmers markets in every city, with globally recognized chefs and culinary experiences at your doorstep.

Calculate your savings

Select your annual income, monthly mortgage, healthcare and grocery costs to find how much you would save with a move to Greater Phoenix.

Austin

Dallas

Denver

Los Angeles

Portland

San Francisco

Seattle

Annual Income

Monthly Mortgage

Monthly Healthcare

Monthly Groceries

Total Annual Savings

$

Source: C2ER 2024 Q1 Cost of Living Analysis; Zillow Research August 2024

Companies in Greater Phoenix enjoy the benefits of low business costs and a minimalist regulatory approach. With housing and workforce costs lower than competitor markets, companies grow and scale in a vibrant operating environment.

Photo: ASU

Annual Business Operating Cost Comparison

The annual business operating cost pro-forma below estimates healthcare manufacturing facilities operating costs in competitor markets across a handful of major expense categories. Component and custom analyses to match your company’s operations can be provided upon request. Contact us to request a custom analysis for your business.

Healthcare manufacturing facilities market comparison

| Metro | Employee Payroll | Fringe and Mandated Benefits | Utilities | Real Estate Payments | Property Tax | Total Operating Cost | Index |

|---|---|---|---|---|---|---|---|

Phoenix |

$22,705,800 |

$5,181,732 |

$506,759 |

$2,700,000 |

$11,496 |

$31,105,787 |

100.0% |

Atlanta |

$23,352,714 |

$5,508,269 |

$549,110 |

$2,152,500 |

$399,700 |

$31,962,293 |

102.8% |

Boston |

$27,468,811 |

$6,417,355 |

$2,415,733 |

$3,362,500 |

$617,000 |

$40,281,399 |

129.5% |

Houston |

$24,251,386 |

$5,559,841 |

$683,379 |

$1,800,000 |

$566,215 |

$32,860,821 |

105.6% |

Nashville |

$22,863,721 |

$5,243,514 |

$715,932 |

$1,910,000 |

$244,050 |

$30,977,217 |

99.6% |

New York |

$27,422,393 |

$6,758,897 |

$1,064,192 |

$4,370,000 |

$0 |

$39,615,482 |

127.4% |

Raleigh |

$22,760,108 |

$5,339,925 |

$481,197 |

$2,400,000 |

$253,125 |

$31,234,355 |

100.4% |

San Diego |

$26,544,121 |

$7,608,153 |

$1,903,601 |

$4,170,000 |

$293,500 |

$40,519,375 |

130.3% |

San Francisco |

$31,578,620 |

$9,041,354 |

$1,328,897 |

$6,990,000 |

$465,000 |

$49,403,871 |

158.8% |

Source: Applied Economics Metrocomp Tool, January 2024

Quality of Life

Experience a vibrant lifestyle and diverse culture at an affordable cost of living

Enjoy the outdoors with more than 300 days of sunshine, average temperatures of 75 degrees, convenient access to over 400 hiking trails and globally recognized sporting events. Take part in a vibrant arts and culture scene that includes prominent classical arts to public art to craft markets and a diverse range of music and cultural events. And, eat well with fresh farmers markets in every city, with globally recognized chefs and culinary experiences at your doorstep.

Calculate your savings

Select your annual income, monthly mortgage, healthcare and grocery costs to find how much you would save with a move to Greater Phoenix.

Annual Income

Monthly Mortgage

Monthly Healthcare

Monthly Groceries

Source: C2ER 2024 Q1 Cost of Living Analysis; Zillow Research August 2024