Industry Outlook Report

June 2025

Having moved to the forefront of the public’s consciousness during the COVID-19 pandemic, the healthcare innovation and bioscience industries1 now find themselves in a period of transitional disruption driven by technological progress and political change.

In the decades leading up to this point, Greater Phoenix established itself as a major market in healthcare innovation, with landmark investments leading to globally recognized specialty healthcare assets and a productive translational research ecosystem, plus a thriving medical technology manufacturing market. The region has built a strong bioscience talent pipeline, with bioscience-related occupation growth at double the national pace over the past decade. Recently, Greater Phoenix Economic Council (GPEC) brought together local leaders in the healthcare innovation and biosciences space to discuss the ecosystem’s future at an Industry Roundtable event. Roundtable participants’ insights contributed significantly to this report.

2,900

Post-Secondary Bioscience Program Completions in Greater Phoenix, 2023

2,550

Medical Students Enrolled in Arizona, 2023

11,700

Medtech and Biomanufacturing4 Jobs in Greater Phoenix, 2024

#1

Major Metro for Percent Growth in Completions, Last 10 Years2

#2

State for Percent Growth in Medical School Enrollment, Last 10 Years3

#1

Major Metro for Percent Growth in Employment Within this Subsector, Last 10 Years5

Growth & Trends: Healthcare Innovation

| 2024 Metric | Regional Context | 5-Year Local Industry Growth Trend | 5-Year National Industry Growth Trend | |

|---|---|---|---|---|

Employment |

284,877 |

11.7% of jobs |

23.8% |

8.2% |

Payrolled Business Locations |

13,800 |

9.4% of payrolled business locations |

28.1% |

14.9% |

Average Earnings Per Job |

$89,780 |

7.4% higher than average earnings for all industries |

13.1% |

13.5% |

Gross Regional Product (GRP) |

$32.8 billion |

9.0% of total GRP |

39.0% |

28.6% |

Source: Lightcast 2025 Q1

Regional Asset Spotlight

| Company/Institute | Description |

|---|---|

Becton Dickinson (NYSE:BDX) |

Medical technology firm with major endovascular peripheral intervention manufacturing unit in Tempe. |

Bristol-Myers Squibb (NYSE:BMY) |

Operates a facility in Phoenix that manufactures biopharmaceuticals, acquired when the firm purchased local biomanufacturer Celgene in 2019 for $74 billion. |

Caris Life Sciences |

Precision medicine company that maintains four locations in Phoenix and Tempe spanning lab and specimen receiving, research and development (R&D), a blood profiling lab and an administrative support office. |

Castle Biosciences (Nasdaq:CSTL) |

Diagnostics company developing innovative prognostic and diagnostic tests that guide patient care; has a clinical operation in Phoenix. |

CND Life Sciences |

Locally grown developer of biomarker tests for neurodegenerative diseases with headquarters in Scottsdale. |

Dexcom (Nasdaq:DXCM) |

Manufacturer of continuous glucose monitoring (CGM) tech; has a manufacturing facility and distribution center in Mesa. |

Medtronic (Nasdaq:MDT) |

Device manufacturer with a vertically integrated manufacturing operation and technology center in Tempe; the firm’s history in the region dates to the early 1970s. |

National Institute of Diabetes and Digestive and Kidney Diseases at the National Institutes of Health (NIH) |

Has its multidisciplinary Phoenix Epidemiology & Clinical Research Branch in the Phoenix Bioscience Core (PBC), where it investigates the etiology of type 2 diabetes mellitus and obesity. |

Translational Genomics Research Institute (TGen) |

Nonprofit medical research institute located in the PBC dedicated to studying the genetic components of disease; a subsidiary of independent cancer research and treatment center City of Hope. |

W. L. Gore & Associates |

Materials science firm with five production and business support operations across Phoenix and Tempe; in-region activity involves the manufacturing of advanced medical devices, implants and meshes. |

Emerging Opportunities

Clinical Trials & Research Specialties

Clinical trials create high-quality local healthcare and bioscience jobs and attract significant amounts of capital into a region. The domestic market for goods and services in the space is valued anywhere between $25 billion and $40 billion. On the product development side, a diverse ecosystem of top-tier healthcare providers is critical to validate new medical technology in today’s competitive medical device, therapeutics, and pharmaceutical landscape. Arizona and Greater Phoenix are ready to meet the demands of industry with multiple research-focused hospital systems. In 2023, Arizona was the site of over 1,040 industry-sponsored clinical trials with nearly 25,500 subjects enrolled.6 Despite ranking 14th in population, Arizona had the 8th highest number of active, industry-sponsored clinical trials that year, showing the state punches above its weight in clinical trial participation. Such outsized prominence is in no small part due to the Greater Phoenix market establishing itself as a world-class healthcare destination. Between 2018-25 (YTD), the region’s hospitals announced no less than $6 billion in capital investments, much of which has funded or will fund new specialty institutes and translational research facilities. Greater Phoenix also offers access to a large and diverse patient population, a feature of great interest to principal investigators and trial sponsors.

The region’s healthcare providers have parlayed strengths in specialty care across fields such as oncology and neurology into nationally recognized translational research capabilities. Greater Phoenix is home to decorated, foundational research talent like Dr. Daniel Von Hoff of TGen, City of Hope, HonorHealth and Mayo Clinic, whose groundbreaking work in oncology has led to numerous anticancer agents in use today and has permanently improved patient care across the globe, as well as Dr. Michael Lawton of the Barrow Neurological Institute (BNI), who has made seminal contributions to the field of neurology ranging from surgical management, to rare cerebrovascular disease etiology, to translational research advocacy. The region also boasts best-in-class Alzheimer’s research infrastructure within the Banner Health system, which operates advanced brain imaging technology and a productive clinical trials system at the Banner Alzheimer’s Institute (BAI). BAI works synergistically with the Banner Sun Health Research Institute, home to the very promising Blood-Based Biomarkers Program for neurodegenerative diseases, led by decorated researcher Dr. Nicholas Ashton. In recent years, Greater Phoenix has increasingly distinguished itself for its strength in first-in-human trials, as exemplified by the BNI Ivy Brain Tumor Center Phase 0 Clinical Trials Program – the world’s largest Phase 0 program. Other high-profile examples include the Neuralink brain-computer interface trial at BNI, and a collaboration between HonorHealth and TGen studying interventions that target advanced gastrointestinal cancers.

Medtech & Biomanufacturing

Medtech and biomanufacturing are production subindustries (including the manufacturing of pharmaceuticals and biologics, diagnostics, medical devices, and dental/medical supplies, among others) whose outputs are used in medical practice and research. These subindustries comprise an economically dynamic industry cluster, as they are collectively expected to see strong global compound annual growth rates (CAGR) into the next decade. Certain future-facing verticals could approach the type of exceptional, 30%+ gains typically achieved only by scalable digital technologies.

| Vertical | Description | Global CAGR Projections (Early 2030s) |

|---|---|---|

Cell and Gene Therapies and Precision Medicine |

Tailored treatments resulting from the manipulation of a patient’s genes or cells. |

27% to 29% |

Implantable Medical Devices |

Devices inserted into a patient’s body to serve a sustained, specific function. |

6% to 7% |

Organ-on-a-Chip Platforms |

Miniaturized chips that replicate the functions of human organs in vitro. |

34% to 35% |

Surgical Robot Technologies |

Robotic systems that assist during invasive procedures with increased precision. |

17% to 18% |

Synthetic Biology |

A bioengineering subdiscipline which alters biological systems for new purposes. |

17% to 26% |

Wearable Devices |

Consumer and medical grade devices that track personal health data. |

14% to 26% |

Source: Survey of various market intelligence reports

Regarding high-potential medtech verticals, the Greater Phoenix market presently boasts an active wearable device ecosystem, home to assets such as Dexcom’s closed-loop CGM production and the WearTech Applied Research Center in Phoenix. Likewise, the market has begun to register on the radar of cutting-edge biomanufacturing firms seeking to locate both advanced production operations and critical, innovative R&D facilities in the region (see “GPEC’s Bioscience Pipeline” section).

GPEC’s Bioscience Pipeline

As of May 2025, GPEC is working with 10 bioscience prospects that are actively considering relocating to or expanding operations in the region. These 10 clients represent a potential of over 2,000 jobs, $10 billion in capital investment and almost three-quarters of a million square feet of facility absorption.

2,000+

Potential Bioscience Jobs in GPEC’s Pipeline

$10B

Potential Capital Investment from Bioscience Firms in GPEC’s Pipeline

Number of Prospects by Facility Type

| Prospect Specialization | Adv. & High Tech Mfg. | Heavy Mfg. | Light Mfg. | R&D | Health Services |

|---|---|---|---|---|---|

Biotechnology |

1 |

||||

Cell-, Gene- and Immunotherapies, and Precision Medicine |

1 |

2 |

|||

Diagnostics and Biomarkers |

1 |

||||

Other and Unknown |

1 |

1 |

|||

Pharmaceuticals and Biologics |

1 |

1 |

1 |

Cell and gene therapies (CGTx), which have been one of medicine’s breakout fields in recent years, may be another area of opportunity for the region. CGTx have enjoyed rapid-fire technological advancements and notched crucial regulatory approval wins, yet some roadblocks to cost effectiveness and scalability remain. These include a complex billing sequence, the labor-intensive, manual processing of blood samples, and the unbroken chain of cold storage that is necessary to retain specimen integrity.

It is not yet clear how the cold storage logistics of commercialized CGTx will resolve themselves at scale, but the technology will almost certainly require proximity to population. This might represent the Greater Phoenix market’s clearest path forward in this emerging industry. Aside from being the 10th most populous U.S. metro with more than 5.1 million residents, the western portion of the region lies within a 5-hour drive of the over 8.0 million combined residents of the San Diego and Riverside metros, and a 6-hour drive of the nearly 13 million people in Los Angeles. The region has nationally acknowledged specialty warehousing and distribution assets – its booming Loop 303 distribution corridor in the West Valley has made national news, and the state is home to over 2,100 bioscience-related distribution firms with a workforce of over 13,000 employees,7 many of which are in Greater Phoenix. This combination of infrastructure and proximity to major population centers could make Greater Phoenix a competitive destination for CGTx firms.

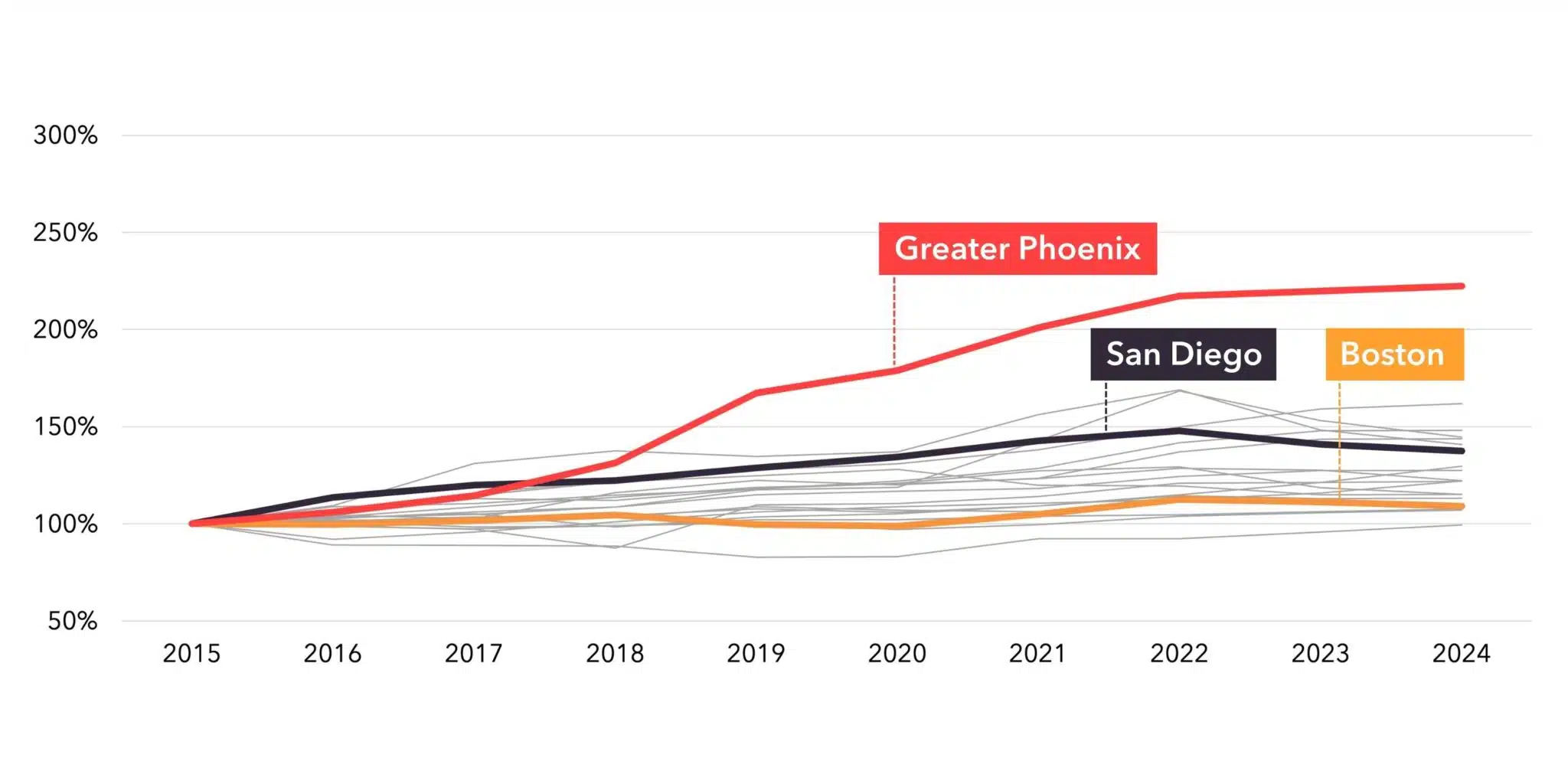

Assessing the holistic scope of growth in this space beyond emerging technology verticals, Greater Phoenix’s evolution over the last decade has been nothing short of explosive. It vaulted from the 30th-largest jobs market for medtech and biomanufacturing in the U.S. in 2015 to the 14th-largest in 2024, with an actively employed labor force approaching 12,000. Employment in the region (highlighted in red in the chart below) has seen nearly two and a half times growth since 2015, far surpassing the other 19 metros that make up the 20 largest domestic employment markets for this industry group and ahead of global nexuses like Boston and San Diego.8

Medtech & Biomanufacturing Job Growth

Top 20 Metro Areas, Employment Indexed to 2015

Source: Lightcast 2025 Q1

The region has pursued a deliberate economic development strategy in the medical device sector, culminating in 2023 with the U.S. Economic Development Administration awarding a Tech Hubs Strategy Development Grant to a group of 28 local private firms and public entities called the Medical Device Manufacturing Multiplier Consortium (MDM2) to enhance local coordination and planning efforts for a regional strategy in medical device manufacturing.

Advanced Industry Clustering

Greater Phoenix’s rise to prominence as a hub of advanced manufacturing has had self-reinforcing effects across high-tech industries. Those medtech and biomanufacturing companies that rely on semiconductors or microelectronics as components for their products benefit from access to Greater Phoenix’s highly developed semiconductor ecosystem. In 2023-24, Greater Phoenix manufacturers in this space made 88% of their purchases from the semiconductor and printed circuit assembly industries in-region, using local suppliers.9 Peer manufacturers located in metros with similarly sized medtech and biomanufacturing labor markets, like Miami, Tampa, and Washington, D.C., must hunt down chip and microelectronics suppliers who are largely out-of-region (11%, 20% and 13% in-region semiconductor purchases, respectively).

The increasing need for miniaturization and ultra-low power consumption in medical technology and wearables, coupled with the imminent arrival of leading-edge wafer production and advanced packaging in Greater Phoenix spearheaded by Intel, Taiwan Semiconductor Manufacturing Company and Amkor, could yield multifaceted business efficiencies for the medical technology sector. Some benefits are practical: the co-location opportunities afforded by the region can simplify procurement, mitigate supply chain risks, and reduce transportation costs while facilitating cross-firm supplier/buyer coordination and troubleshooting. Other benefits could be multiplicative and transformational: the region’s diverse semiconductor landscape might foster co-development or co-investment partnerships between the chips, medical manufacturing, and biomanufacturing fields – driving targeted, sector-specific innovations in biomedical electronics and microelectronics, such as organ-on-a-chip platforms.

Unique Infrastructure Needs & Strategies Driving Future Success

Adapting to Federal Spending Drawdowns

The Trump administration’s planned cuts to agency spending, as well as reductions to Medicaid funding being considered by Congress, are likely to impact a wide array of federal funding sources that touch the healthcare innovation and bioscience industries. Higher education is uniquely exposed to this planned retrenchment of financial support, and Arizona’s flagship state universities may be no exception. According to the Flinn Foundation’s latest Arizona’s Bioscience Roadmap report, combined research and grant funding to the state from NIH, a subagency of the Department of Health and Human Services (HHS) which is likely the world’s single largest funder of research in biology and medicine, grew 27% between 2020-24 compared to 7% in the nation at large. The majority of 2024 statewide NIH distributions (69%, over $252 million) went to Arizona’s public universities. Since HHS appears to be slated for considerable budget cuts in the government’s coming fiscal year, potential disruptions to university research staffing and operations in the health sciences and biosciences could be severe.

More broadly, Arizona’s combined public and private healthcare innovation and bioscience sector is not critically exposed to HHS contract awards. HHS monies constituted under 3% of all federal awards to the state’s healthcare innovation and bioscience ecosystem between 2018-24, much less than in peer states such as Georgia (nearly 9%) and Minnesota (nearly 14%).10 One positive potential outcome of structural changes to current research funding models could be the involvement of industry earlier in the research chain. There is some evidence that capital sources are beginning to consider strategic realignment in advance of federal funding cuts, as venture firm Lux Capital announced plans to allocate $100 million to commercially viable academic research in May of 2025.11

Medical Talent Retention

Regional retention of young physicians is a growing concern, and for good reason: the Association of American Medical Colleges estimates that the nation may suffer a shortage of 86,000 physicians by 2036.12 The possible ramifications of such a deficit are chilling: reduced access to care for local populations, decreased quality of care, and increased physician burnout, to cite a few. Arizona is seeing a mixed performance in the nationwide competition to retain young physician talent. In 2023, 43% of Arizona’s practicing physicians had attended medical school in-state, and 49% had completed their residency in-state. For context, this ranks 18th among 53 states and territories across both measures, and above the national average in both cases.13 This news, however, masks an unwelcome emerging trend: the percentage of Arizona’s new attending physicians (those with less than 10 years of post-residency experience) who have remained in-state to practice after residency has been trending downward relative to the national average, reaching a six-year low versus the nation in 2023.14

Beyond physicians, Arizona’s long-term projected workforce sufficiency for the most in-demand allied health occupations roughly tracks that of the nation. However, the state may be on course to suffer a deficit of over 11,000 licensed practical nurses by 2037. Because healthcare workforce shortfalls are expected to hit rural areas harder than metros, Greater Phoenix may be in a somewhat better position than the table below indicates. Still, the healthcare system will either have to find ways to fill looming talent gaps or develop novel care models that rely on available occupational mixes. Several Industry Roundtable participants shared the opinion that the state and region have largely succeeded in establishing robust medical talent pipelines, led by assets like the recently opened Creighton University School of Medicine in Phoenix, but must now widen the scope of their mission to include enticing greater shares of homegrown and imported talent to remain here in an increasingly competitive landscape.

| Profession | Arizona Supply Adequacy, 2037 | U.S. Supply Adequacy, 2037 |

|---|---|---|

Licensed Practical Nurses |

36% |

64% |

Nurse Practitioners |

160% |

176% |

Pharmacists |

98% |

96% |

Pharmacy Technicians |

131% |

120% |

Registered Nurses |

92% |

94% |

Source: U.S. Health Resources and Services Administration Workforce Projections

Turnkey Wet Lab Space

Greater Phoenix is in need of significantly more turnkey wet lab space to grow its bioscience sector. Though Connect Labs by Wexford and the Center for Entrepreneurial Innovation are doing excellent work connecting tenants to modern lab facilities, lab space at these locations is largely leased up, and the region’s lab construction pipeline is dormant as of May 2025. Shell space is available on the market, but many smaller bioscience firms that require wet lab space lack the available liquid capital to invest in fit-out. For companies in the market for shell space, the region remains a competitive market for bioscience real estate fit-out. Typical per-square-foot fit-out costs across a variety of bioscience real estate types (labs, CGTx, clean rooms, etc.) in Greater Phoenix are about 10% lower than the national average.15

Early-Stage Connective Programming

Greater Phoenix’s healthcare innovation and bioscience market enjoys a rightly deserved collaborative reputation. Still, the region lacks a handful of key connective programs and ecosystem roles geared toward companies in the early phases of product development. The first is an end-to-end medical device applications laboratory where nascent firms can prototype, pilot, validate, commercialize and lay the regulatory groundwork for their technology. Several such centers with different ownership and business models exist across the country, such as Johnson & Johnson’s Center for Device Innovation at the Texas Medical Center, a corporate-led prototyping and R&D facility in Houston, and The LaunchPort, a public-private partnership in Baltimore offering comprehensive product development services to medical device startups.

Second, the region could benefit from a programmatic solution to a common needs-matching problem in clinical trials: misalignment between a startup’s product and the healthcare system it is soliciting to sponsor trials. Such disconnects may be personnel-driven (lack of a relevant physician champion), mission-driven (differing therapeutic or clinical priorities), or patient population-driven (lack of relevant demographics). In any case, it would be to the benefit of the region to set up an information-sharing system that could match startups to a clinical partner with corresponding needs and capabilities. Evolving into a market that is known for optimizing and, to the extent possible, de-risking the beginning of the medical product development journey could constitute a powerful next step for Greater Phoenix, as doing so will likely increase inflows of both investment-stage companies and investment capital within the region.

Download the PDF on the Future of Healthcare Innovation and the Biosciences.

Industry Expert

Allison Bakovic, Ph.D.

Vice President, Bioscience Business Development

1. The definition of the healthcare innovation industry in this report covers all healthcare services (NAICS codes 621, 622 and 623) plus medical device/supplies manufacturing (3391, 334510, 334516 and 334517). The terms “biosciences / bioscience industries” encompass research and development in the life sciences and related fields (541713, 541715 and 541715), pharmaceutical and medicine manufacturing (3254) and testing labs (541380).

2. Lightcast 2025 Q1. Cohort of 29 metros which as of 2024 were either major population centers, or major bioscience employment markets, or both.

3. Association of American Medical Colleges. (2024). 2024 Key Findings and Definitions. Cohort of 47 states and two territories.

4. The medtech subindustry consists of NAICS codes 334510, 334516, 334517, 339112, 339113, 339114, 339115 and 339116. Biomanufacturing consists of 325411, 325412, 325413 and 325414.

5. Lightcast 2025 Q1. Cohort of 20 metros which as of 2024 had the highest employment in the medtech and biomanufacturing industries.

6. Arizona Bioindustry Association. (n.d.). Clinical Trials in Arizona.

7. Biotechnology Innovation Organization. (2024). Arizona 2024 Fact Sheet.

8. Lightcast 2025 Q1

9. Lightcast 2025 Q1

10. USASpending.gov. (2025). Advanced Search.

11. Gormley, B. (2025, May 22). Lux Capital Digs Deeper Into Academia for Technological Gems. The Wall Street Journal.

12. Association of American Medical Colleges. (2024, March 21). New AAMC Report Shows Continuing Projected Physician Shortage.

13. Association of American Medical Colleges. (2024). U.S. Physician Workforce Data Dashboard.

14. Association of American Medical Colleges. (2019-2024). Report on Residents, Table C6. Physician Retention in State of Residency Training, by State.

15. CBRE. (2024, October 1). Life Sciences Construction Benchmarks & Trends 2024.

Published: 06/24/2025