Greater Phoenix Economic snapshot: Office & industrial panel

Published: 09/13/2018

Updated: 10/09/2019

Although companies continue to operate—and in some cases, expand in established markets such as the Bay Area, New York, Washington, D.C. and Seattle—rising costs and intense competition for talent continue to motivate business leaders to look at Greater Phoenix as a place to scale and cost optimize.

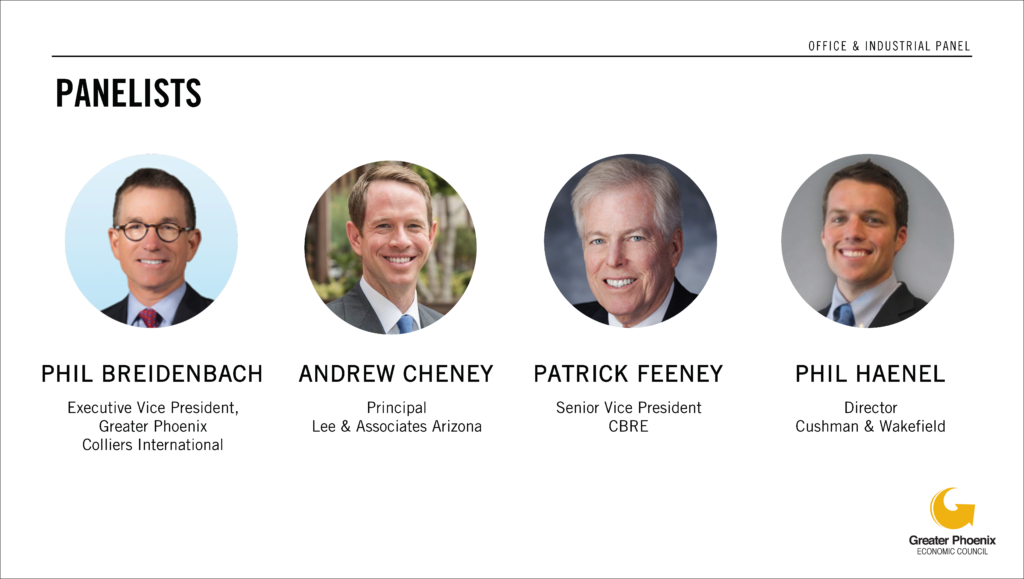

To provide insight on the current office and industrial market trends in Greater Phoenix, Greater Phoenix Economic Council (GPEC) hosted an office and industrial panel at the Community Building Consortium (CBC) meeting, featuring industry experts:

- Phillip Breidenbach, Executive Vice President at Greater Phoenix Colliers International

- Andrew Cheney, Principal at Lees & Associates Arizona

- Patrick Feeney, Senior Vice President at CBRE

- Phil Haenel, Director at Cushman & Wakefield

With more than 40 attendees in the audience, our Senior Vice President of Business Development, Brad Smidt, kicked off the panel with a thought-provoking discussion.

What are you seeing in terms of power or the rail system in the industrial world?

Patrick Feeney explained that having access to water and power are crucial, especially for manufacturing companies. Additionally, he mentioned that the industrial world is concentrated around where people live and the walkability – people want to be close to work.

Phil Haenel added, “Labor, housing and affordability were the deciding factors for Chewy, when selecting Greater Phoenix,” he said. “In Greater Phoenix, 63% of people can afford a home. If you’re in San Francisco, the only 6% can do the same.”

What’s driving tenants to buildings? What are they looking at?

When beginning the search for an office space, one of the first things tenants consider is location. Andrew Cheney mentioned that the location must be centrally located in an area where people like to work. Additionally, amenities and flexibility play a big role in their decision.

Phil Breidenbach added, “We talk a lot about our office clients and about 90% of them are looking for existing space. If you start at the 101 and Elliott and the 202 in Gilbert, you see new company signs popping up in that area. Other companies are seeing these names and it is encouraging them to move there.”

Where do you see our market going in the next 24 months?

Greater Phoenix is proving to be a hot spot for industrial real estate. According to CBRE’s Phoenix Industrial Market View Q2 2018, the Phoenix industrial market continued to perform in the second quarter of 2018 as healthy tenant demand outpaced new supply. Overall, vacancy decreased 30 basis points during the quarter to 6.4%—the lowest rate since Q2 2006.

All four panelists had very optimistic answers about our market:

PB: With three major employers new to the market around the Loop 101 and 202 area, the momentum will just keep coming.

AC: I think we’re going to continue having robust activity.

PH: There will be an increase of 10-15% all across the board. We’re bold in the market and we’ll have a strong finish to the year.

PF: I’m optimistic that we are good for the next 3-4 years. Phoenix is so well-positioned right now from an infrastructure standpoint and so many people continue to move here. There are a number of graduates from ASU, GCU, UofA in addition to so many tech-savvy young individuals. Other markets are challenged with natural disasters like hurricanes and floods. I think we’re pretty lucky right now.

Having a robust labor market, dependable infrastructure and accessibility are just a few reasons why Greater Phoenix is a desirable market. Learn more here.