Opportunity zone program

Published: 01/14/2019

Updated: 02/28/2022

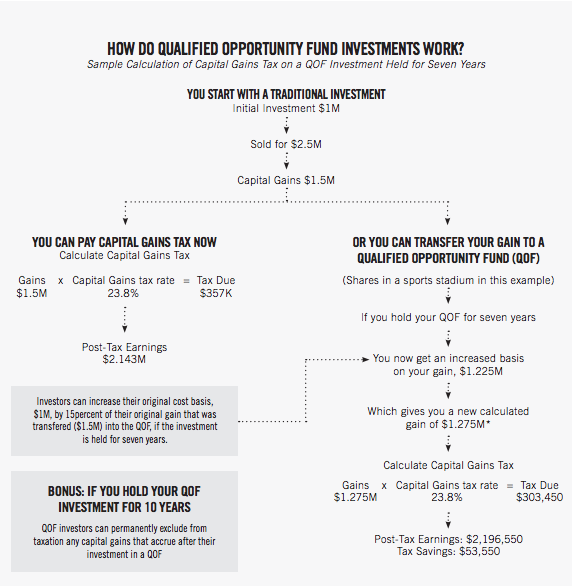

The Tax Cuts and Jobs Act (TCJA) created the Opportunity Zones program to increase investment in economically distressed communities by modifying the standard tax treatment of capital gains in several ways. These modifications either delay or reduce the capital gains tax liability of investors. But to qualify for these benefits, investors must reinvest one or more capital gains in a Qualified Opportunity Fund (QOF).

*New Calculated Gain is selling price of gain invested minus increased basis ($2.5M – $1.225M). This calculation does not include earnings made from the QOF investment.

SOURCE: TAX FOUNDATION