Regional Report: An expansion strategy driving jobs – Nerve Centers

Published: 07/23/2020

Updated: 12/08/2020

A GPEC Virtual Series

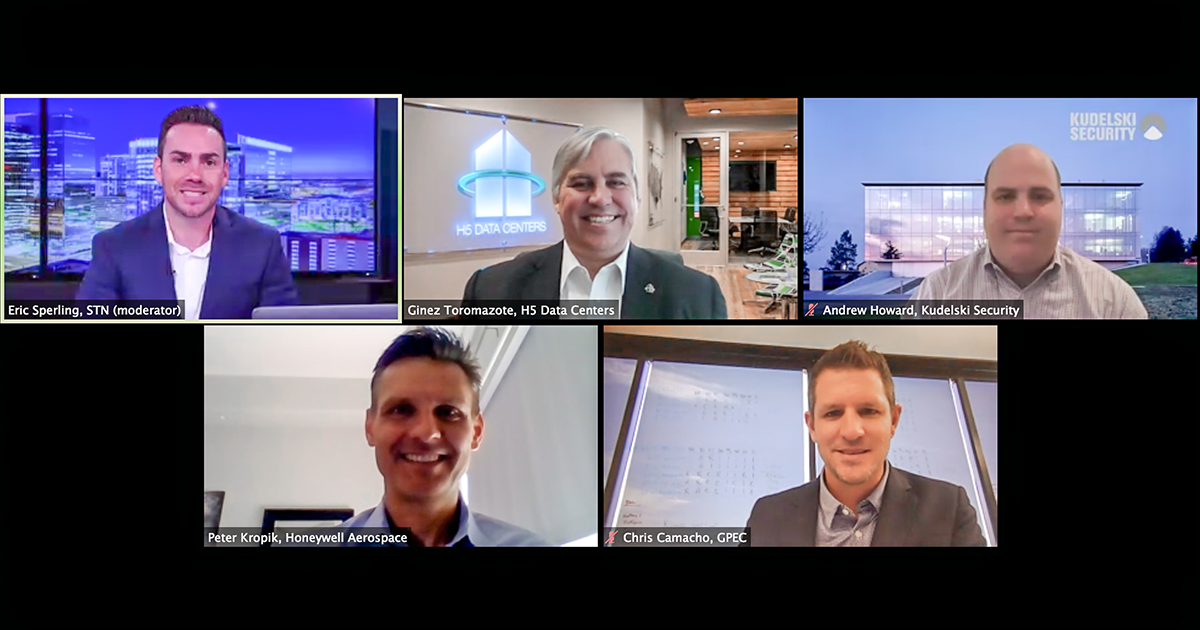

The recent Regional Report featuring the release of the Greater Phoenix Economic Council’s (GPEC) Market Intelligence Report on ‘Nerve Centers,’ was the sixteenth installment in the virtual series exploring industries in Greater Phoenix impacted by the current COVID-19 pandemic.

You can watch the webinar via the video below and read the full report HERE.

‘Nerve Centers’ are the latest evolution of corporate shared services that place heightened importance on process innovation, utilization of Industry 4.0 technologies, and integration of operations and information across the organization.

GPEC President & CEO, Chris Camacho, discussed the findings, evolution, benefits and importance of ‘Nerve Centers’ to the region’s economy and recovery efforts as they represent the future of advanced job creation in our market.

Greater Phoenix’s shared services evolution spans several decades. Beginning in the late 1980s, firms began decentralizing various business functions. Call centers and other back office operations were shifted away from traditional hubs like New York, Los Angeles and Chicago, and into low-cost emerging markets across the U.S. and abroad.

“Major corporations here, they’re adding high-value units into the Greater Phoenix Region,” says Camacho. “They’re no longer the cost optimized focus of the company to come here for cheap labor, but rather, coming here for the qualified labor with the redundant infrastructure that allows these businesses to evolve because now they’re the backbone of many of these companies.”

Today, Greater Phoenix is a hub for these critical business units with 106 companies having ‘Nerve Center’ operations with at least 100 employees including Honeywell Aerospace, Acronis, Silicon Valley Bank and Kudelski Security, to name a few. Companies have achieved significant operational benefits (data below) by centralizing disparate traditional back office operations — HR, payroll, finance, procurement, legal, customer service and IT — into regional operations hubs, allowing front-line operations to focus on production and service provision.

“What I’ve seen in really the last decade…we’re on the horizon with the Dallas, the metro-Atlanta’s, the Charlottes, that not only have pro-business approaches to from a policy standpoint, but also continue to scale labor in a way that makes it attractive to grow and scale here [Greater Phoenix],” says Camacho. “I expect for us to see that in years to come.”

‘Nerve Center’ Data

- Shared services adoption led to significant productivity improvements in 79% of companies

- Shared services adoption reduced general and administrative spending by as much as 40%

- Shared services adoption increased customer satisfaction scores by as much as 40%

Honeywell Aerospace, which has seven facilities and 10,000 employees throughout the state, is one company who has scaled its footprint in Greater Phoenix and benefited greatly. Peter Kropik is the vice president of customer and product support, and chief information officer at Honeywell Aerospace, and he discussed what makes the region ideal for centralized business units.

“I’ve been in Phoenix now for 28-years and the landscape in Phoenix has changed significantly around who we are as a state, the economic environment,” he says. “The capabilities that are being developed; they drive partnering opportunities. It’s also bringing more workers; it’s bringing more skill. I’m just very excited to see how we continue to develop Phoenix – it’s very strategic for us from a Honeywell perspective.”

Ginez Toromazote, director at H5 Data Centers, which has an 180,000 square-foot facility in Chandler, Arizona, pointed to a recent study which shows why Greater Phoenix is advantageous for data centers. In fact, the region is the second fastest-growing data center market in the U.S. and top-five in the nation by size.

“This [Phoenix] is basically a very low risk market from a geographical perspective,” he says. “Most of the large-scale, hyper-scale and cloud service providers in the world are calling Phoenix home. It only generates a larger demand.”

The low risk environment made it an easy decision for H5 Data Centers to come to Greater Phoenix.

“When we look at the low natural disaster risk involved in the market, they’re very convenient and very favorable for any mission critical application,” he says. “Companies seeking that sort of resiliency, and security, and reliability, to obtain the efficiencies that any mission critical environment deserves, Phoenix is just a phenomenal place to be able to collocate that environment.”

Toromazote also says the region’s low power costs make it attractive compared to other markets.

“San Diego power rates fluctuate anywhere from 20 to 48 cents per kilowatt hour. Phoenix is on average conveniently below seven cents a kilowatt hour,” he says.

Toromazote expanded on the region’s value.

“The technology innovation, the great workforce, the ability to be able to service the enterprise cloud, and digital infrastructure and information technology for disaster recovery and cognitive application is second to none,” he says. “Phoenix is quickly becoming the Ashburn [Virginia] of the west, and those are large words.”

Another mission critical business unit is cybersecurity and Andrew Howard, CEO of Kudelski Security, which is headquartered in Phoenix, highlighted the company’s reasons for scaling in Greater Phoenix.

“Access to talent, great luck accessing the university systems, as well as just accessing the technical schools and other talent pool generally,” he says. “We run a fairly large data center in the Phoenix area, and we have been quite pleased, not only with the rates, but the access and the stability. We’re just hiring a lot.”

Howard also noted lifestyle, quality of life and cost of living access in Greater Phoenix.

“I want to work with high-end customers to solve high-end problems, but they [employees] also want the ability to live an outdoor lifestyle and enjoy the beautiful scenery and the lifestyle the Phoenix area offers.”

Camacho pivoted to the importance of continuing to attract companies and knowledge workers to the market. One reason – tax generation.

“An $80,000 wage earner creates about three and a half times the net new tax generation than the medium income earner,” he says. “The more educated workers we bring to our market, the more tax revenue that generates for our communities.”

There are abundant opportunities ahead for Greater Phoenix when it comes to scaling ‘Nerve Centers,’ but Camacho says, “I think it’s really important that we don’t rest on our laurels as a great growth market.”

“We must continue to produce STEAM talent or STEM talent. That’s really a P through 20 model probably even more exacerbated now with this focus on digital delivery of education applied learning,” he says. “We must provide access, better access for more of our low-income students to get on that education pathway to create economic value for our future. We must continue investing not only in basic infrastructure – water, wastewater and roads – but future digital infrastructure.”

Camacho says cultivating pro-business policies towards advanced industries, and promoting urban development and mobility are central to Greater Phoenix’s future growth.

As a result of the COVID-19 pandemic, 250,000 people have been dislocated in Arizona. The panel agreed that the need to reskill and retrain these workers to meet the needs of advanced industries is going to be critical as demand grows.

“We are unstoppable if our labor delivery systems meets the needs of companies,” says Camacho. “We need to triple down on that and that be our focus.”

Greater Phoenix has evolved from a locale for affordable call centers and back-office operations, to a modern industrial hub that integrates technology, knowledge and innovation across all industries. As essential business operations converge with Industry 4.0 technologies, Greater Phoenix’s unique economic and cultural attributes make it a prime location for a diverse range of nerve center operations. Greater Phoenix has established itself as a place where companies can leverage technology and innovation to scale and add value to clients and stakeholders.

For more information about how your critical business units can scale and thrive in Greater Phoenix, visit GPEC.org, email info@gpec.org or call 602.256.7700.