Report Highlights

01

Greater Phoenix is poised to become a premier cybersecurity locale in the current decade, bolstered by a flourishing technology sector, skilled workforce and a healthy innovation ecosystem.

02

The global cybersecurity skills gap surpassed 3 million people in 2020, leaving over half of global firms significantly exposed to cyberattacks. Closing the skills gap requires strategic investment and cross-sector collaboration at the industry and regional levels.

03

The acceleration of enterprise cloud computing adoption has triggered a cloud IT security revolution where enterprise and cloud services providers increasingly rely on cybersecurity professionals to protect larger and more complex data infrastructure from cyberattacks.

04

Cybersecurity firms are innovating with artificial intelligence and machine learning to automate security processes allowing security teams to focus on the most pressing issues and do more with less.

05

Firms are also searching for ways to utilize the redundancy and immutability of blockchain technology to create new layers of protection that makes data tampering harder and easier to detect.

Cybersecurity Demands Continue to Grow

Data security is an increasingly tall order. Thanks to Industry 4.0 technologies including 5G, Software-as-a-Service (SaaS), cloud computing, mobile services, and the Internet of Things (IoT), the digital landscape has grown in both size and complexity.

Global cybercrime costs are projected to increase 15% year over year, reaching an annual cost of $10.5 trillion by 2025.i Cybersecurity remains a growing concern for industry leaders who rely on data to manage their operations. On average, a data breach costs $3.9 million and takes 280 days to identify and contain.ii Organizations face a two-pronged challenge as they work to secure larger, more vulnerable data networks and face mounting consequences if they fail.

$3.9M

Average cost of a data breach

15%

Projected annual cybercrime cost increase

Key Trends Influencing Cybersecurity

Labor needs and emerging technologies continue to drive the cybersecurity industry’s evolution. Consequently, several key trends have emerged as key influencers within the space.

A widening skills gap

The increasing IT security needs of the cloud

Integration of artificial intelligence and automation in cybersecurity operations

Blockchain experimentation and innovation

Cybersecurity is Thriving in Greater Phoenix

5th

largest data center market in the country

361%

growth in information security analyst employment

70+

local companies who specialize in cybersecurity

In light of these trends, Greater Phoenix is well positioned to capitalize on the growing cybersecurity demands of the modern economy and be a premier cybersecurity destination.

Throughout the 21st Century, Greater Phoenix has cultivated a software and IT ecosystem bolstered by legacy semiconductor, aerospace and defense technology sectors. Strategic investment in digital infrastructure has helped Greater Phoenix to become the fifth largest data center market in the country. With globally recognized players like Kudelski Security and Acronis SCS offering comprehensive security management, advanced R&D, and consulting services, Greater Phoenix has the resources and expertise that firms need to secure their data. No less than 70 companies specialize in cybersecurity services or offer them as part of a suite of software and IT services in Greater Phoenix.i

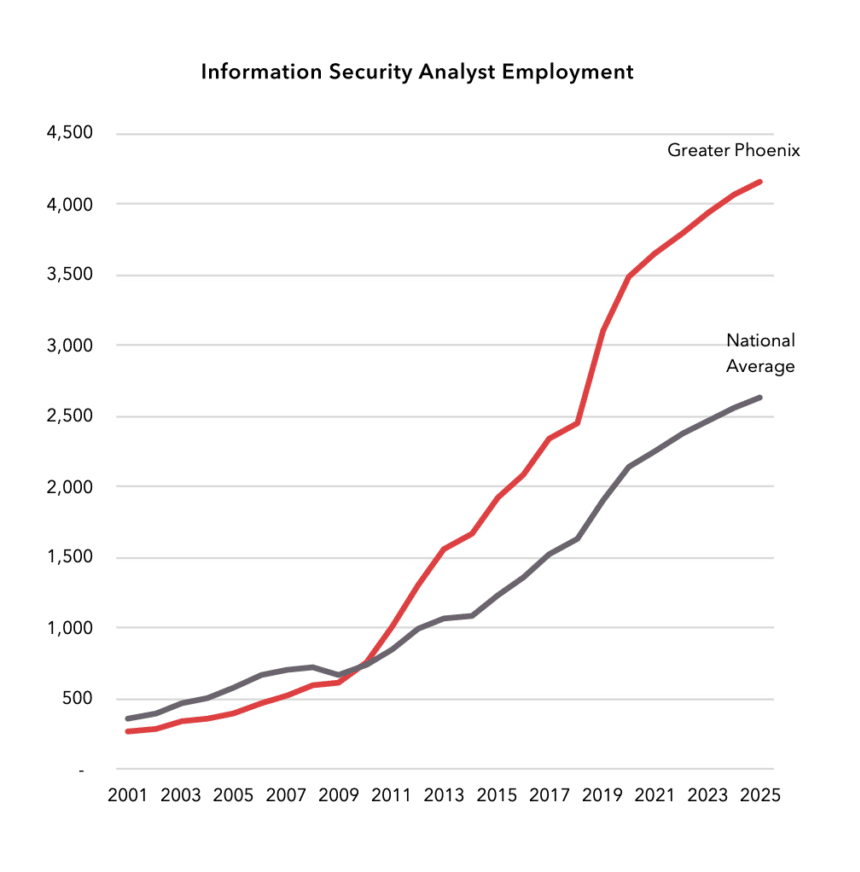

Greater Phoenix is also a hotspot for information security professionals. In 2010, information security analyst employment in Greater Phoenix was on par with the national average. Since, it has grown 361% — roughly double the national growth rate of 184% — and is expected to grow another 20% by 2025.

Source: Emsi Occupation Snapshot Report, Q2 2021

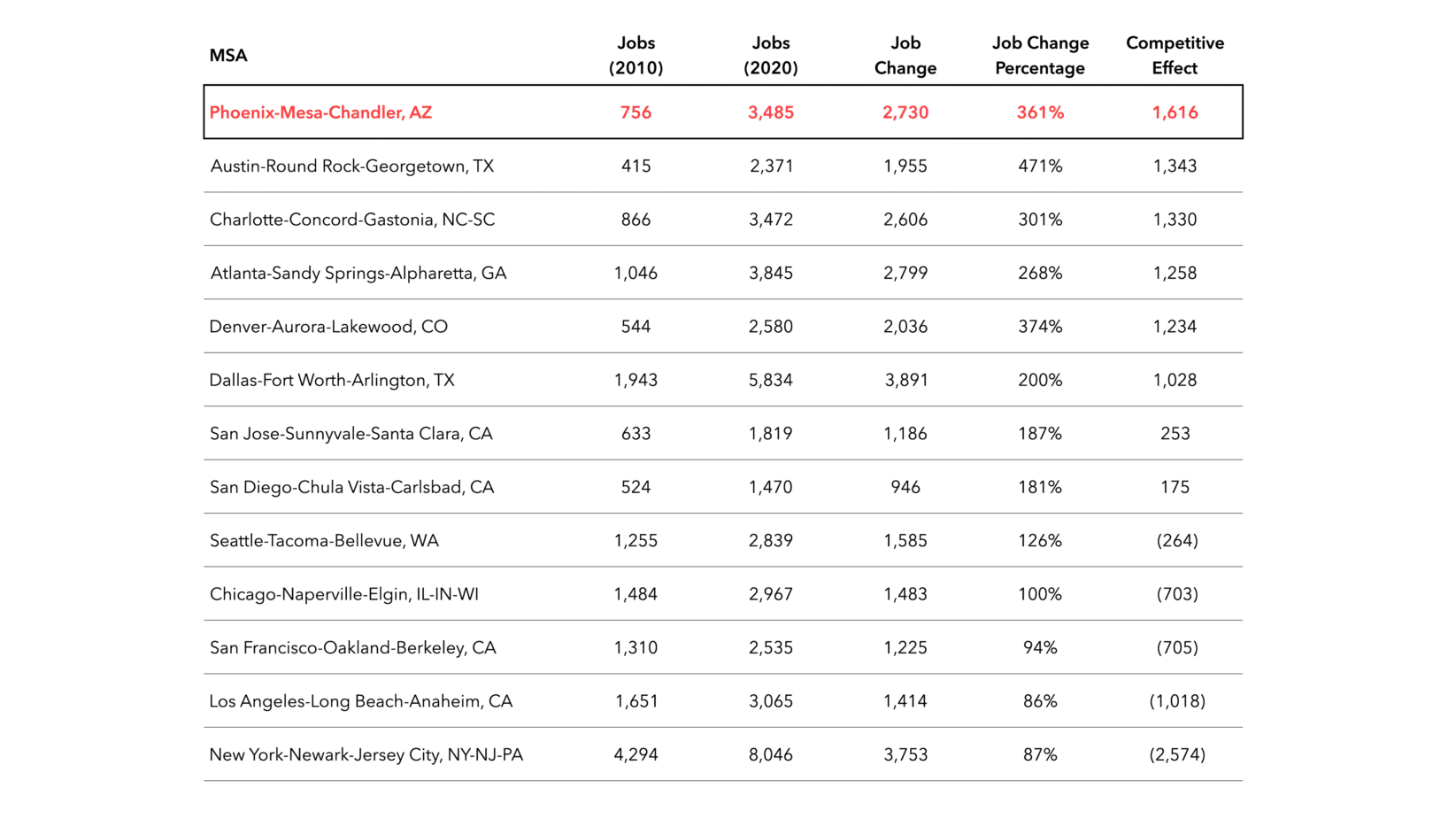

Greater Phoenix holds a strong position relative to other competitor markets. Global talent shortages and rising demand for advanced security services continue to drive local sector growth. Greater Phoenix’s information security analyst job growth over the last decade surpasses most major U.S. tech hubs including Austin, Denver, San Jose and Seattle. Additionally, Greater Phoenix’s “competitive effectiv” is one of the highest in the nation. As the table illustrates, nearly 60% of regional information security analyst job growth is attributed to unique economic, natural and cultural characteristics that make Greater Phoenix a competitive and attractive region for cybersecurity professionals.

Source: Emsi Regional Comparison Report, Q2 2021

Greater Phoenix is Building the Future of Cybersecurity

Greater Phoenix’s cybersecurity sector also benefits from strong public and private investment into R&D and technology transfer. One example is the Center for Cybersecurity and Digital Forensics (CDF) at Arizona State University, which works with entrepreneurs, researchers, and cybersecurity experts to cultivate the cybersecurity workforce of the future and help bring new technology to market. In just a few years since its inception, CDF has generated several U.S. patents and startups, and collaborated with tech companies including Google, Microsoft and PayPal, as well as government agencies including the U.S. Department of Energy, the National Science Foundation, the Office of Naval Research and the Army Research Office.

Competitive Effect

2730

Greater Phoenix’s information security analyst job growth over the last decade.

59%

of the job growth was driven by the unique characteristics that make Greater Phoenix competitive

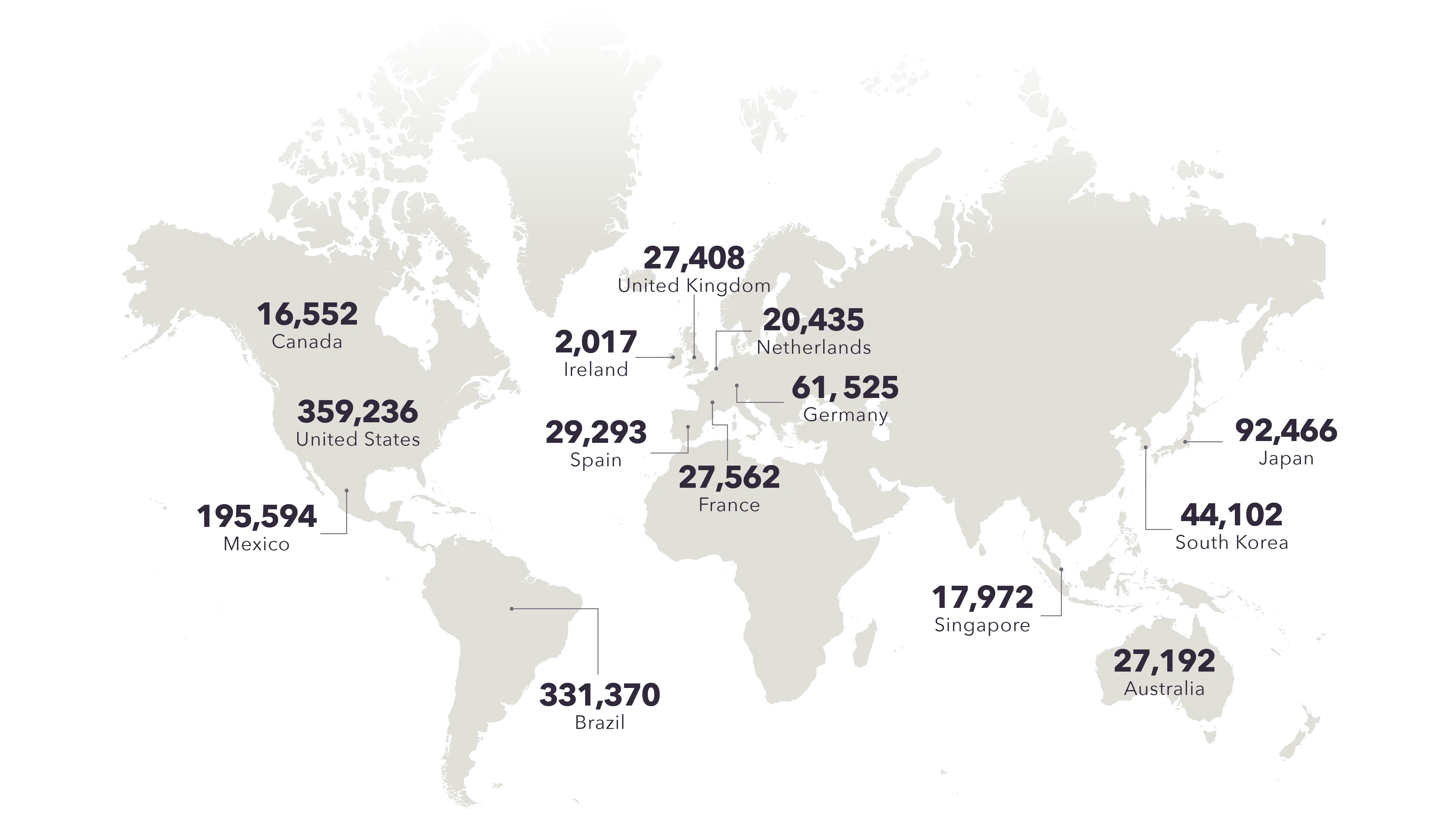

Labor Shortages Remain a Global Issue

The global cybersecurity skills gap has continued to widen in recent years, surpassing 3 million people in 2020.v As many as 64% of organizations have an understaffed cybersecurity team, leaving them at moderate or extreme risk of cyberattacks.vi Closing the gap will require strategic investment and public-private collaboration among employers, educators and government.

Source: (ISC)2 Cybersecurity Workforce Study, 2020

Fortunately, Greater Phoenix benefits from a strong and innovative education system that collaborates with other public and private partners to produce more than 6,000 degrees and certificates in computer science and IT-related fields annually.vii Cybersecurity students and professionals can choose from dozens of educational offerings from institutions including:

The region is also rich with vocational training programs designed to kick start IT and cybersecurity careers. Arizona Joint Technical Education Districts including the East Valley Institute of Technology (EVIT) and the Western Maricopa Education Center (West-MEC) offer applied training and postsecondary credentials for high school students and young adults. The Maricopa County Community College District (MCCCD) offers prep courses for Cisco (CCNA/CCNP) and CompTIA Security+ certification. In 2019, MCCCD partnered with Amazon Web Services (AWS) to develop a cloud computing and blockchain certificate program. Students and professionals also have access to the Arizona Cyber Warfare Range (AZCWR) — a privately funded non-profit institute that offers ‘live-fire’ practice environments and competitive games for cybersecurity professionals looking to hone their skills. AZCWR also offers testing for new security technologies and can provide real-world assessments and performance statistics.

Security Demands of the Cloud are Growing

Cybersecurity has moved to the cloud. The global cloud storage market was $49 billion in 2019 and is expected to reach nearly $300 billion by 2027.viii Thanks to its cost effectiveness, flexibility and scalability, enterprise cloud computing is nearly ubiquitous in the modern economy, and the rise of remote work continues to drive demand. A recent study by McKinsey estimates roughly 40% of the U.S. workforce is capable of working remotely at least part time . This flexibility could result in a permanent tenfold increase in remote work compared to pre-pandemic levels.x

As more workers connect to their home computers, laptops, and mobile devices, they introduce new vulnerabilities and greatly increase the attack surface of cloud-based data networks. Cloud computing configurations are highly complex and simple misconfigurations can lead to major losses. Consequently, cloud service providers, data centers and enterprises increasingly rely on managed security services providers (MSSPs) to ensure their complex networks remain secure.

“ Greater Phoenix’s local demand for security professionals is growing quickly thanks to the robust finance, insurance, data center and professional services sectors—industries with some of the highest demand growth for cloud services.”

Greater Phoenix’s local demand for security professionals is growing quickly thanks to the robust finance, insurance, data center and professional services sectors — industries with some of the highest demand growth for cloud services. Greater Phoenix has also long been a desirable location for corporate nerve centers — comprehensive, integrated operations hubs that increasingly leverage IT and other enterprise technology to drive operational innovation. More than 50% of Greater Phoenix nerve centers house IT and data management operations, all of which require robust information security measures.xi Increasing local demand driven by these sectors correlates with a rise in MSSP providers in the region including AccountabilIT, Avertium, ClearDATA, Sitelock, Transmosis and many others.

Artificial Intelligence & Automation are Driving Efficiency

To address growing demands, cybersecurity experts are turning to artificial intelligence (AI) and machine learning to help automate many security processes including inventorying of web assets, network scans, web certificate verification, vulnerability identification, testing and triage, and monitoring for recurring vulnerabilities. This frees up cybersecurity teams to focus on the most pressing security issues first while also helping to ensure the same vulnerabilities don’t occur in the future.

Local cybersecurity firms leveraging AI include Bishop Fox, Trapp Technologies and Cyr3Con with the latter recently closing an $8.2 million venture capital funding round in 2020. These firms and others like them benefit from Greater Phoenix’s local innovation ecosystem driven by R&D at local universities. One example of this is Arizona State University’s Global Security Initiative, which in 2017 established the Center for Human, Artificial Intelligence and Robot Teaming to deploy tools and best practices for managing human-AI collaboration. As AI and automation supplant many traditional tasks, forward thinking initiatives like this help drive the creation and growth of new occupations in which humans work closely alongside advanced technologies.

Blockchain Adds Another Layer of Security

Another nascent technology transforming cybersecurity is blockchain — distributed ledgers managed collectively via peer-to-peer networks offering data immutability and redundancy. Originally rooted in fintech and cryptocurrency, blockchain’s potential as a decentralized, secure and scalable data management tool has led to wider experimentation in bioscience, government, healthcare and telecommunications. Blockchain’s decentralization means that multiple users can authenticate data entries into “the chain”, making it harder for hackers to alter the data and easier for cybersecurity teams to detect data tampering.xii In a relatively short time, blockchain has become a crucial value-adding component of comprehensive data security strategy and continues to expand across all business sectors.

In recent years, Arizona has become recognized as a hub for blockchain innovation, thanks to groundbreaking regulatory efforts spurring technological innovation and a growing ecosystem of research and education. In 2018, Arizona became the first state to implement a regulatory ‘FinTech Sandbox’, which has allowed startups like Sweetbridge to test their blockchain-enabled financing technology without the normal barriers to entry. In 2017, Arizona became the first state to pass a law recognizing smart contracts — digital signatures recorded on a blockchain — as legally binding as paper contracts. Greater Phoenix continues to welcome new startups and established firms like Kudelski Security, Path Network and ZorroSign who are creating innovative blockchain-enabled security solutions. Other initiatives including the Arizona Blockchain Initiative and ASU’s Blockchain Research Laboratory are pioneers of applied research and education around blockchain.

Greater Phoenix can Become a Global Cybersecurity Leader

Greater Phoenix has emerged as an economic leader amidst the fourth industrial revolution, but there are opportunities the region must advance to meet future demands of the cybersecurity industry.

Invest in K-12 STEM Education Outcomes

Further investments in STEM education as part of a comprehensive K-12 curriculum, coupled with efforts to bolster Arizona’s high school graduation and post-secondary matriculation rates — including not just those of colleges and universities, but also community colleges and trade school programs — are more essential now than ever to the future prosperity of Greater Phoenix.

Promote Public-Private Collaboration in Workforce Development

Despite a robust talent pipeline, local demand for cybersecurity experts remains unabated. Workforce is the number one consideration for technology companies looking to relocate or expand operations. Employers and educators must collaborate to develop apprenticeships and curricula that lead to applied experience and formal credentials. The cybersecurity field is highly specialized and there are dozens of formal certifications that target various specialties. The Certified Information Systems Security Professional (CISSP)

certificate remains the gold standard among industry professionals. However, growing digital complexity necessitates other specialty accreditations including the Certified Cloud Security Professional (CCSP), the Certified Secure Software Lifecycle Professional (CSSLP) and several others. Employers must effectively communicate their specialized needs and be willing to invest in local educational offerings that target the needed certifications and expertise. This ensures employers have access to a healthy labor pipeline and students have marketable skills out of college.

Invest in Opportunities to Upskill

Greater Phoenix is great at producing entry-level talent, but many local employers struggle to attract and retain middle management and high-skilled professionals. Employers and educators must work collaboratively to provide more avenues for training and promoting junior-level talent to senior-level talent, in turn growing the high-skilled labor pool. The benefits of high-wage job growth will spill over into other sectors of the economy via increased consumer purchasing power, indirect creation of jobs in adjacent industries, and increased local tax revenues, thereby improving quality of life and increasing regional competitiveness.

Continue Investments in Digital Infrastructure

Greater Phoenix’s Information and Communications Technology (ICT) infrastructure has largely kept up with growing demand in recent decades. Yet regional leadership must ensure that infrastructure is able to keep up with rapid population growth and the fast-changing needs of technology users and innovators. Organizations such as The Connective: A Greater Phoenix Smart Region Consortium and the Arizona Blockchain Initiative are currently leading the charge through regional collaboration and novel, innovative solutions.

Promote Public-Private Collaboration on Public Infrastructure Security

The security of local governments and public infrastructure is also a growing concern. As local and state governments turn to the cloud, they face the challenges of cloud security on a vastly larger scale compared to enterprise. Public leadership must work collaboratively with cybersecurity professionals to protect the public from potentially catastrophic cyberattacks.

Acknowledgements

GPEC would like to thank Acronis, Acronis SCS, Early Warning Services, Kudelski Security and ZorroSign for their valuable input and feedback on this report.

Endnotes

i. Steve Morgan. November 2020. “2021 Report: Cyberwarfare in the C-suite.” Cybersecurity Ventures.

ii. IBM. 2020. “Cost of a Data Breach Report 2020.”

iii. GPEC analysis of Gregslist and Crunchbase cybersecurity company data. Accessed April 23, 2021.

iv. Competitive Effect is the measured difference between expected change — based on broad industry and national economic trends — and actual change.

v. (ISC)2. 2021. “(ISC)2 Cybersecurity Workforce Study, 2020.”

vi. Ibid.

vii. Emsi Education Pipeline, Q2 2021

viii. Fortune Business Insights. 2020. “Cloud Storage Market Size, Share & Industry Analysis, By Component, By Deployment, By Enterprise Size, By Vertical, and Regional Forecast, 2020-2027.”

ix. Lund, S., Madgavkar, A., Manyika, J., & Smit, S. 2020. “What’s next for remote work: An analysis of 2000 tasks, 800 jobs, and nine countries.” McKinsey & Company.

x. Global Workplace Analytics. n.d. “Work-At-Home After Covid-19 — Our Forecast.” Accessed April 22, 2021.

xi. Greater Phoenix Economic Council. 2020. “The Modern Shared Services Model: Nerve Centers.”

xii. Deloitte — Blockchain & Cyber Security, 2017

Interested in saving a copy?

Read through the full report below and download the PDF to save a copy.

Published: 07/01/2021