Report Highlights

Read through the full report below and download the PDF to save a copy.

01

As Industry 4.0 technologies continue to drive the “smart factory” evolution, producers are more reliant on regions that offer secure, redundant and low-latency digital infrastructure to meet their growing data needs.

02

Manufacturers across the country are adopting more consumer-centric business models to build direct relationships with end-users, improve product controls, and shorten production cycles. Many firms seek to aid these efforts by leveraging their local software and IT services sectors.

03

Recent economic shifts brought about by the COVID-19 pandemic and other events have dramatically altered global trade for the foreseeable future. As manufacturers adapt, they will be drawn to regions that offer fast, convenient access to growing markets, including those in Mexico and Canada.

04

Regions with a strong track record of collaboration and investment in skilled workforce development, particularly in the fields of data science, software development, cybersecurity and artificial intelligence, are better equipped to meet the growing workforce needs of manufacturers.

05

More manufacturers are reevaluating their competitive position, with many choosing to

relocate and even re-shore existing operations to new locales where they can leverage the local talent and resources of target markets.

06

Greater Phoenix is well positioned to capitalize on these industry trends and expects to see manufacturing sector growth that outpaces most other major markets in the Southwest and West Coast.

The Global Manufacturing Landscape is Changing

Nearly all U.S. markets have seen precipitous declines in manufacturing in recent decades due to automation and globalization. However, changes to the current economic landscape create new opportunities for U.S. manufacturers that are able to adapt. As the manufacturing landscape evolves, several key themes have emerged as integral to manufacturing competitiveness in the coming years.

Key Themes in Industry Competitiveness

“Smart Factory” technology and digital infrastructure

Skilled workforce development and attraction

Evolution and diversification of supply chains

Strategic re-shoring and domestic market embeddedness

Vertical integration and adoption of consumer-centric business models

Location remains critically important for manufacturers, but the reasoning behind where a firm chooses to locate is changing rapidly. As manufacturers adapt to a fast-evolving technological and economic landscape, they are increasingly leveraging the assets within their local ecosystems, forming collaborative partnerships to innovate, create new business models and build digital prowess.

Desirable Destination for Expansion

238

Manufacturing operations relocated or expanded to Greater Phoenix in the last decade (2009 - 2019)

38%

90 of the 238 were in 2018 and 2019 alone

Expected Job Growth

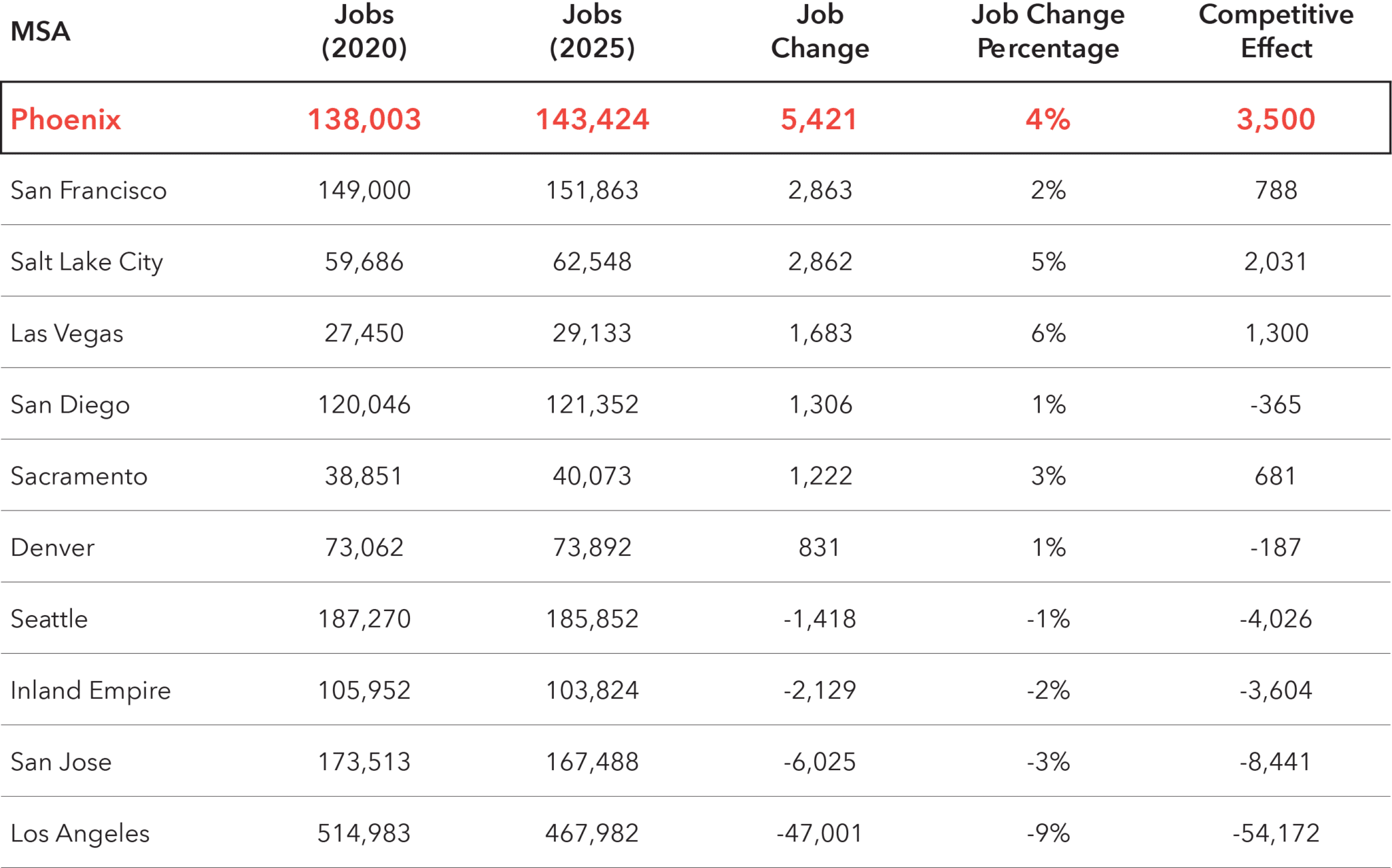

Greater Phoenix’s competitive position is expected to net more than 5,400 new manufacturing jobs by 2025, significantly outpacing the growth in major western markets.i

Furthermore, Greater Phoenix’s competitive effect—the measured difference between expected and actual change—is estimated to grow by 3,500 jobs over the next five years, meaning that approximately 65% of expected job growth in the region is not driven by broader national or industrial trends, but by the unique characteristics that make Greater Phoenix competitive.

Competitive Effect

5421

Greater Phoenix is estimated to grow by 5,421 jobs over the next five years.

65%

of expected job growth in the region is driven by the unique characteristics that make Greater Phoenix competitive

Modern Manufacturing Relies on Smart Infrastructure

The dichotomy of ‘traditional’ vs ‘advanced’ manufacturing is fast disappearing. Industry 4.0 technologies such as automation, robotics, IoT, artificial intelligence (AI) and machine learning are now essential as manufacturers seek to improve efficiency, productivity, safety and customer satisfaction. Cloud computing and predictive analytics are becoming ubiquitous as manufacturers use smart sensors to closely monitor equipment performance and worker safety in real time and proactively address any maintenance issues or occupational hazards. Industrywide, these implementation efforts are expected to increase productivity by as much as 25% and generate an additional $630 billion annually in operational costsii over the next five years. Doing so requires reliable, modern digital infrastructure and high-speed, low-latency broadband internet, which allow firms to collect, store and analyze vast amounts of data in real time.

Greater Phoenix’s technology sector is growing in both scale and diversity.

Legacy aerospace, defense, and semiconductor industries have given rise to newer clusters in software and software-as-a-service (SaaS), information technology (IT), data centers, cybersecurity, autonomous vehicles, wearables, haptics, sensors, and biomedical technology. In addition to a growing tech hub, Greater Phoenix is also a major hub for corporate IT services and is the 5th largest data center market in the countryiii with dozens of data co-location companies offering infrastructure-as-a-service (IaaS) to meet manufacturers’ growing data needs. These industry clusters have spurred investment in modern digital infrastructure to provide the reliable, low-latency connectivity that smart factory operations require. As manufacturing operations grow more data intensive, they also grow more exposed to cybercrime and data theft. Fortunately, local firms can leverage the region’s robust cybersecurity ecosystem which includes industry-leading firms, cutting-edge research on AI and blockchain technology, and an information security workforce that has grown by 286% since 2010.iv

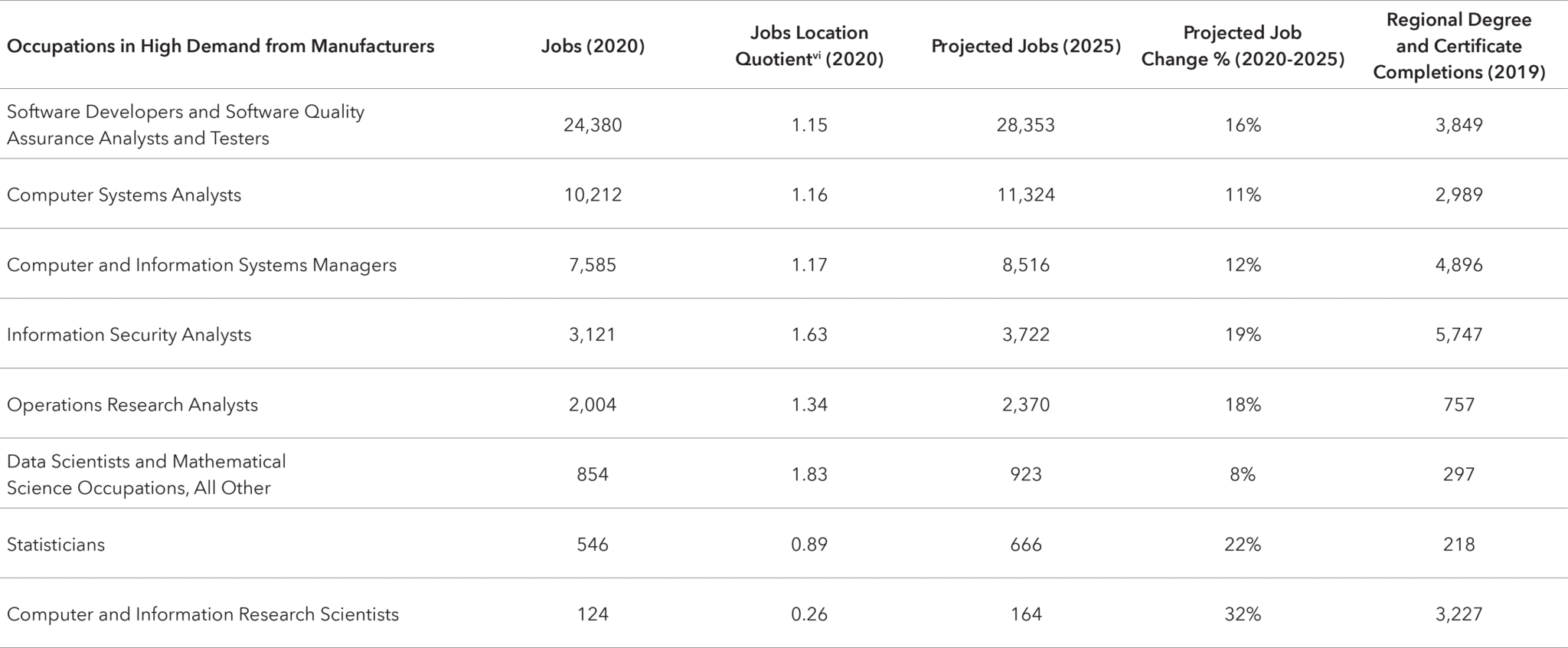

Demand for Skilled Labor Continues to Grow

As manufacturing becomes more technologically sophisticated, there is a growing skills gap. Attracting and retaining a quality workforce remains the greatest challenge for manufacturers.v This is unsurprising considering that countries across the globe are experiencing a rising skills gap in fast-growing fields such as data science, analytics, software development, IT security and AI.

Greater Phoenix’s skilled workforce has grown by double-digit percentages in recent years thanks to an influx of young millennial workers moving to the region and a large post-secondary education ecosystem that produces thousands of STEM graduates every year. Regional collaboration among employers and educational institutions is growing to meet the fast-evolving skills demands of the region, ensuring that Greater Phoenix continues to be a premier location for manufacturing operations.

Manufacturing Jobs in Demand

Source: Emsi Q3 2020 Regional Comparison Tables

Manufacturers are Becoming More Consumer-Focused

SaaS platforms, 3D printing, and the rise of e-commerce have made it much easier for manufacturers to vertically integrate all stages of a product cycle from prototyping to end-user delivery, with many choosing to pull out of wholesale and business-to-business (B2B) markets in favor of a business-to-consumer (B2C) model that connects them directly to their products’ end users. Doing so affords manufacturers greater control over their pricing and brand, and the ability to engage in product innovation while reducing time to market.vii

Greater Phoenix is home to nearly 200 companies offering e-commerce, enterprise resource management (ERM), point of sale (POS), payments processing, and business management and analytics services that can help manufacturers transform their business model.viii Long recognized as a prime market for customer service and contact center operations, the region has since blossomed into a top destination for IT-and customer service-intensive corporate nerve centers, with a plethora of IT and customer relationship management (CRM) solutions providers for manufacturers looking to build direct connections with end-users.

Top Companies Doing Business in Greater Phoenix

More Manufacturers are Considering Domestic Production

In the current global landscape, the value proposition for U.S. domestic manufacturing is increasing. Political pressure to bring manufacturing back to U.S. shores, coupled with rising operating, labor and supply chain costs in many foreign markets, have manufacturers reconsidering where they set up shop.

Companies are also seeking to embed themselves within or near target markets, connecting with local communities and tapping into their talent and resources. Doing so helps companies to build a positive image among local consumers and increase market penetration.

For manufacturers looking to expand their domestic operations. Greater Phoenix offers relatively low operating costs, affordable land, targeted incentives, and a collaborative “plug-and-play” environment where manufacturers can quickly and easily set up shop and tap into the local ecosystem. Logistically, Greater Phoenix is an ideal location with proximity to major consumer markets in the southwestern U.S. and Mexico. The region’s geographic position within the Arizona Sun Corridorix is especially valuable for consumer-focused manufacturers that want to be closer to their customer base, allowing them to reach more than 35 million consumers in just a single day’s truck drive.

35M+

Consumers served within a single day’s truck haul

Greater Phoenix’s value proposition is further increased by its growing reputation as an innovation hub and testing ground for autonomous vehicle technology led by companies including Waymo, Local Motors, Lucid Motors, GM, Toyota, Ford, Nissan, and Volkswagen. This technology is soon expected to become critical to last-mile parcel delivery, with 80% of parcels being delivered by autonomous vehicles.x

Global Supply Chains are Evolving

Recent trade tensions between the U.S. and China, the passing of the USMCA, and the effects of the COVID-19 pandemic have dramatically altered global trade for the foreseeable future.xi U.S. manufacturers now more than ever are reevaluating their supply chains to reduce risk of disruption and avoid tariffs. U.S. imports from China were down by more than ten percent between 2018 and 2019 while imports from Vietnam and Mexico rose 37% and 6%, respectively.xii

Although Arizona has no coastal ports, it is home to six ports of entry, including one of the nation’s largest located in Nogales. Phoenix-Mesa Gateway Airport is also home to SkyBridge Arizona, the nation’s first ever join U.S. and Mexico inland port and customs hub that reduces cargo wait times and expedites cross-border trade. Mexico is Arizona’s biggest international trading partner, exchanging $17.5 billion in goods in 2019.xiii Such assets mean that, in addition to proximity to high-value markets along the west coast, Arizona manufacturers have ease of access to Mexico’s fast-growing B2C e-commerce industry valued at over $22.6 billion.xiv

The Future is Bright for Greater Phoenix Manufacturing

Despite the devastating effects of the COVID-19 pandemic, Greater Phoenix’s manufacturing sector remains strong thanks to a healthy and diverse industrial and tech ecosystem that has much to offer manufacturers.

The presence of supporting industries including nerve centers, cybersecurity, data centers, e-commerce and distribution centers ensure continued growth and Greater Phoenix as manufacturing evolves. Greater Phoenix is poised to emerge from the pandemic stronger than ever and is positioned to be a national leader in manufacturing.

To ensure Greater Phoenix continues to optimize its manufacturing impact, the following actions will be critical:

- Advance pro-business tax and regulatory policies for base industries

- Strategically invest in statewide infrastructure and transportation networks

- Promote policies that encourage the use of clean and renewable energy

- Support the growth of university research programs and graduates through efforts like the New Economy Initiative

- Aid the alignment of Maricopa Community Colleges and local school districts with industries of the future

- Promote bi-national collaboration between Mexico, Greater Phoenix and Southern California to enhance the attractiveness of North American manufacturing and supply chains

Endnotes

i. Emsi. 2020. Industry Tables, Q3 2020. Economic Modeling, LLC.

ii. Deloitte. 2017. “Predictive maintenance and the smart factory.” Deloitte Development LLC.

iii. CBRE. 2020. “North American Data Center Report H1 2020.” CBRE, Inc.

iv. Emsi. 2020. Regional Comparison Tables, Q3 2020. Economic Modeling, LLC.

v. Paul Wellener, et al. 2020. “Navigating disruption: Five trends influencing tomorrow’s manufacturing industry.” Deloitte Development LLC. Accessed December 10, 2020.

vi. Location Quotient (LQ) is calculated by comparing regional share of an occupation (% of all jobs) compared to the national share. An LQ higher than 1 indicates that the region has a higher proportion of jobs in a given occupation when compared to the nation as a whole.

vii. Martin Boggess. 2020. “11 Trends That Will Dominate Manufacturing in 2021.”Hitachi Solutions, Ltd. Accessed December 10, 2020.

viii. Gregslist. 2020. “Phoenix Gregslist.” Scaling Point LLC. Accessed December 10, 2020.

ix. The Arizona Sun Corridor is a fast-growing conurbation that encompasses central and southcentral Arizona. The region includes five metropolitan areas: Phoenix, Tucson, Prescott, Sierra Vista-Douglas, and Nogales.

x. Martin Joerrs, et al. September 2016. “Parcel delivery: The future of last mile.” McKinsey & Company.

xi. Paul Wellener, et al. 2020. “Navigating disruption: Five trends influencing tomorrow’s manufacturing industry.” Deloitte Development LLC. Accessed December 10, 2020.

xii. Deloitte. 2019. “2020 manufacturing industry outlook.” Deloitte Development, LLC.

xiii. Consulate General of Mexico in Arizona. 2020. “Arizona-Mexico Relationship.” Accessed January 26, 2021.

xiv. J.P. Morgan. 2019. “E-commerce Payments Trends: Mexico.” J.P. Morgan Chase & Co. Accessed December 30, 2020.

Interested in saving a copy?

Download this report as a PDF to save a hard copy.