GPEC Ambassador Event: Affordable Housing

Published: 12/07/2020

Updated: 04/01/2021

The availability of affordable housing is vital for the growth and equity of any large city, but providing access to housing is one of only a handful of necessary services needed to lift underserved populations. Municipalities, non-profit organizations, the private sector and federal agencies like the U.S. Department of Housing and Urban Development must collaborate to address and solve the issues facing our communities.

Access to healthcare and financial literacy are equally important means to help residents of Greater Phoenix on the low end of the socioeconomic scale.

“Affordable housing is a key foundation for any community,” said Gary Sneed, Desert Financial Credit Union Senior Vice President & Chief Lending Officer. “It takes the collaboration of public, private and all aspects of the community to make sure we’re doing the right thing. Finding a way to be involved, make sure that we can generate resources, whether it’s in education, or making programs available and having the capital available to help further the cause, if you will, of creating affordable housing, because it’s the right thing to do and the best thing to do for our communities.”

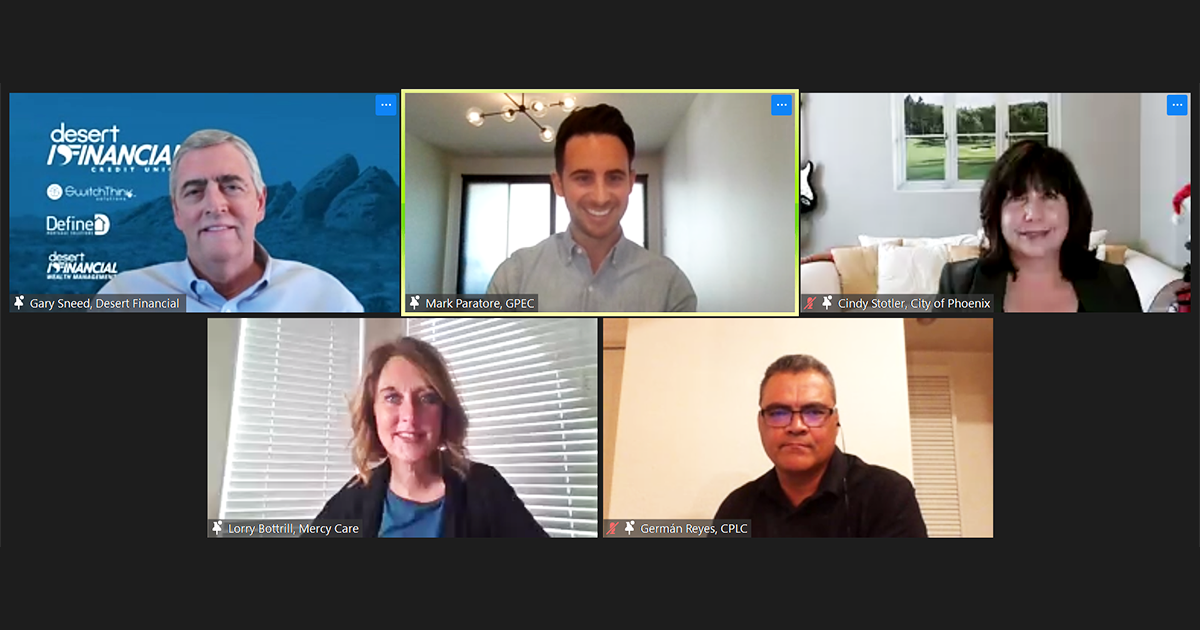

Four community leaders joined our ambassador event to discuss affordable housing background, policy and plans that have been put forth to help increase access. Panelists include:

- Lorry Bottrill, CEO, Mercy Care

- German Reyes, Executive Vice President, Real Estate Operations, Chicanos Por La Causa

- Cindy Stotler, Housing Director, City of Phoenix

- Gary Sneed, Senior Vice President & Chief Lending Officer, Desert Financial Credit Union

Maricopa County was the fastest-growing county in the country for three consecutive years from 2015-2018.

The housing market in Greater Phoenix did not keep up with the population growth.

From 2010-2018, Phoenix’s population increased by nearly 300,000 people, but the number of new units “came to a virtual standstill” because of the Great Recession, Stotler said. With growing disparities between the amount of new housing and increase in population in each of the last three decades, there is now a housing shortage in the region.

Over the last 30 years, there have been about 220,000 new housing units in Phoenix. The population increased by about 820,000.

“That scarcity has been causing housing costs to rise faster than most residents’ income growth,” Stotler said.

Between 2010 and 2018, Phoenix’s area median income increased by 10%. That was outpaced by median rent, which increased by 28%, and median home price, which experienced growth of 57%.

“In 2019, Mayor (Kate) Gallego … recognized that there is an affordable housing crisis in Phoenix,” Stotler said. “She asked the housing department to create a dedicated staff position and engage in a comprehensive study of affordable housing needs in the city of Phoenix and then come back to council with a recommendation.”

Over the next year, Stotler and her team worked to identify the affordable housing need and existing housing and complete a gap analysis comparison to create guidance.

They found that Phoenix was in need of 163,000 units, almost two-thirds of which need to be subsidized because 65% of the population would have to pay more than 30% of their income to afford rent or mortgage payments.

Chicanos Por La Causa is one of the organizations that funds and builds affordable housing units in Greater Phoenix.

It was awarded $132 million to use across eight states and Washington, D.C. by the Neighborhood Stabilization Program that was created in 2008. Using this, CPLC has generated program income of slightly over $100 million and continues to use this money to operate its projects.

In Phoenix, these housing programs include Tonatierra, which has 53 units that have a 9% tax credit, the Travel Inn Motel Conversion, which helps veterans and domestic violence abuse victims, and Broadway and Central Redevelopment, which is expected to create more than 200 units.

CLPC also invested in opportunity zones, one of which is fully entitled and permitted.

“I think (it) could be a wonderful vehicle to entice folks,” Reyes said. “We can bring those dollars in and mandate, kind of put our own national objectives on that, to be able to meet some of this gap that we know exists right now for some of this affordable housing.

Further expansion of affordable housing is dictated on funding, land space and zoning ordinances that decree where affordable housing can be constructed and offered.

Stotler said the major barriers her study found from talking to a thousand developers were cost and zoning NIMBYism, an acronym for “not in my backyard.”

“[There is] an education campaign that we are going to roll out hopefully in 2021 to talk to people about who really needs affordable housing, like teachers and young professionals, and people like that that I think will change their mind, hopefully, about who is coming into these multi-family projects, be it market rate or affordable,” she said.

But housing people in need is just the first step. Mercy Care operates with a focus on health care for those in affordable housing.

“Just putting someone in a home doesn’t always mean that that’s a success,” Bottrill said.

The third-largest housing program in Arizona, Mercy Care houses more than 3,500 people and has a 95% retention rate. In November 2020, it announced a $1.2 million award spread across projects in Phoenix, Flagstaff and Tucson, Ariz.

It also manages the regional behavioral health authority for Maricopa County and is contracted by the Arizona Health Care Cost Containment System, serving more than 425,000 people on Medicaid and Medicare.

“A lot of focus from us around peer mentoring, assistance with daily activities, how to deal with conflict resolution and situations that might involve some crisis and things like that, along with case management,” Bottrill said.

“If we are able to get housing and then provide those wrap-around services, we’re just seeing some really incredible impact not only in their lives and fulfilling living to their potential, but also really reducing health care costs and the trips to the ED or the crisis system as well.”

Getting a person into affordable housing and a healthier living situation is not the end goal. Once they’re in, it’s important to provide residents with means to work themselves out.

Sneed said improved financial literacy and education is a vital need for this to happen. Programs exist that help first-time and low-income buyers qualify for lower down payments and help improve FICO scores.

“(There) are a couple myths that are related to, ‘How do I buy a home?’” Sneed said. “One of the biggest myths that we need to communicate and educate is that I can’t buy a home unless I have 20% down payment.”

The W.I.S.H. Down Payment Assistance Loan provides qualified applicants with a three-to-one match on down payments, and organizations including Fannie Mae and the Federal Housing Administration offer help with down payments below 4%.

“I see that they’re underutilized across Arizona and industry-wide … because of communication, awareness and education,” Sneed said.

As a GPEC investor, people and businesses are joining private sector and civic leaders who are dedicated to creating long-term economic sustainability in Greater Phoenix. To learn more about becoming an investor and joining our Ambassador program, please visit our dedicated investors webpage or contact Nicole Buratovich, GPEC’s Senior Director of Investment Strategy & Engagement at nburatovich@gpec.org.