Greater Phoenix: An established military region with unmatched access perfect for the aerospace industry

Since the mid-20th century, Arizona has had a rich history in aerospace and defense. With large military bases including Davis-Monthan Air Force Base, Fort Huachuca, Luke Air Force Base, and Marine Corps Air Station Yuma, the state and region offer access to a strong aerospace ecosystem. Greater Phoenix is a top market in the nation to locate, relocate, or expand your aerospace and defense operations. In fact, the region’s aerospace and defense sector is one of the largest in the nation.

Aerospace & Defense Industry Report

Get our 29-page, in-depth report on the aerospace & defense ecosystem in Greater Phoenix.

Reliable Infrastructure

Greater Phoenix has the second-most reliable power grid in the nation and boasts access to more than 34 million people in seven states within a one-day truck haul, including major seaports in Los Angeles and Long Beach. Firms have access to nearly the entire Southwest within a two-day haul.

Established Industry Cluster

Legacy Aerospace Companies in Greater Phoenix

Greater Phoenix is a well-established industry hub of worldwide leaders in the aerospace and defense sector.

Greater Phoenix has an ecosystem that allows both legacy and emerging aerospace & defense companies to thrive. With access to Arizona’s strong supply chain, robust military assets and an ideal geographic location, A&D operations are set up for success from the start.

4th

Arizona has the fourth-highest concentration of aerospace manufacturing jobs in the nation.

Source: Lightcast 2021 Q1

$15B

Department of Defense awarded $15 billion in contracts to companies in Arizona in FY2022

Source: U.S. Dept. of Defense

F-35

Luke Air Force Base is the preferred training site for the F-35 Lightning Fighter Jet.

Source: Luke Air Force Base Facts Sheet

Download the full industry analysis for more on A&D operations in Greater Phoenix.

Robust Workforce

Aerospace & Defense Talent Pool

Greater Phoenix has long been a top market in the nation to locate and expand aerospace & defense operations. From training thousands of pilots during World War II to developing cutting-edge space technologies today, the aerospace & defense industry soars in the region. Through university alignment and specialty programs, potential and future employees in the region are set up for success on all levels concerning A&D. Today, Arizona is home to more than 40,000 aerospace and defense industry employees.

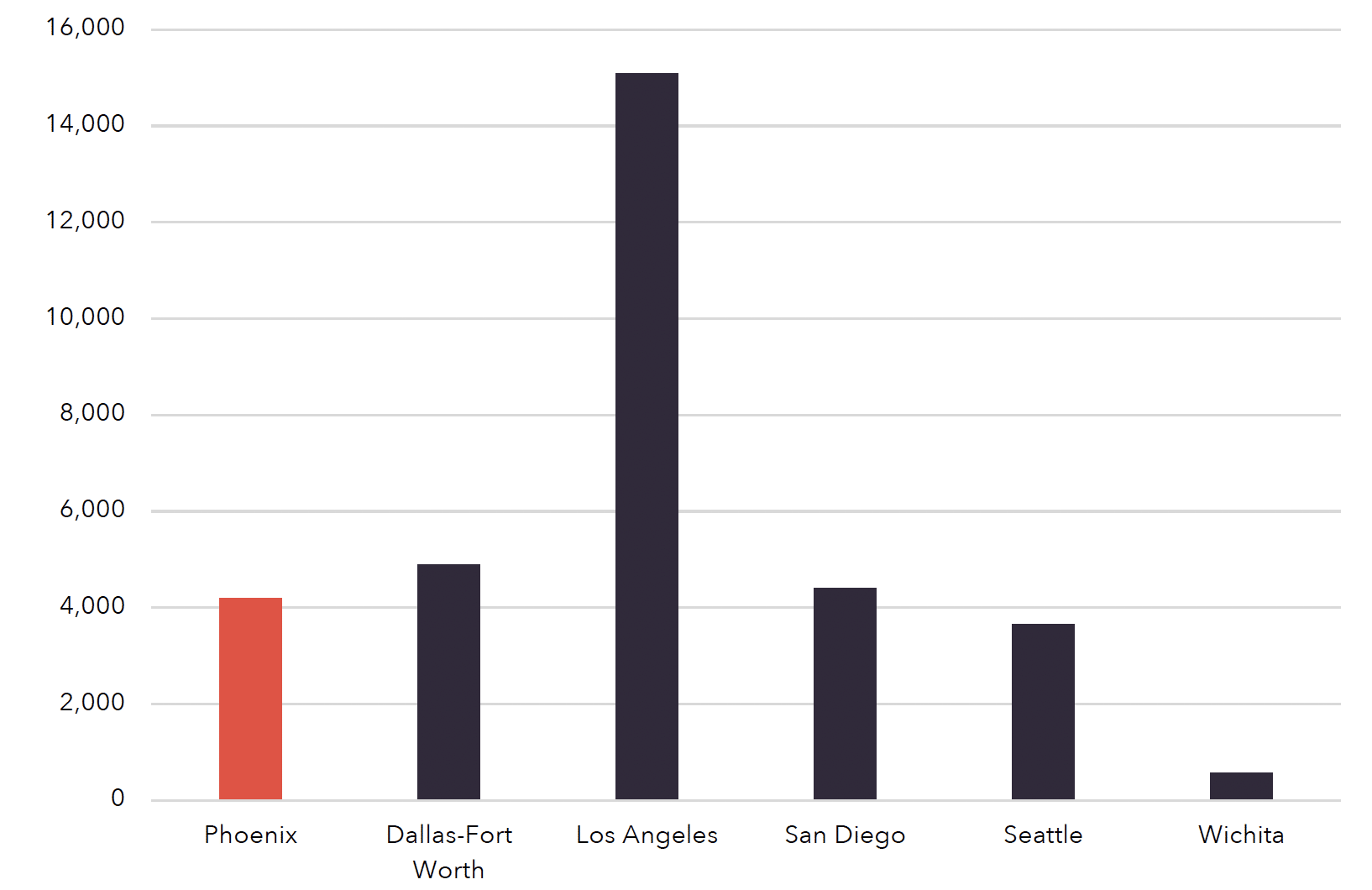

Aerospace and Defense Location Quotient in Greater Phoenix

Employment Concentration (EC) is a measure of market specialization in an industry achieved by comparing the share of that market’s employment in an industry to the national proportion of that industry’s employment. For example, Phoenix’s EC of 1.91 indicates that the market has 91% higher concentration of the aerospace & defense cluster than the national average. The figures below show the magnitude and specialization of major markets’ workforce in the aerospace & defense cluster. As can be seen, Greater Phoenix has a large and highly concentrated workforce that is comparable to aerospace hubs like St. Louis and San Diego.

|

Metro |

Jobs |

Location Quotient |

|---|---|---|

Phoenix |

40,062 |

1.91 |

Dallas-Forth Worth |

90,240 |

2.50 |

Los Angeles |

117,223 |

2.04 |

San Diego |

23,160 |

1.56 |

Seattle |

91,698 |

4.65 |

St. Louis |

20,139 |

1.60 |

Wichita |

27,839 |

9.97 |

Download the full industry analysis for more on the Greater Phoenix talent pool.

Exceptional Talent Pipeline

Aerospace & Defense Education Programs

Local public and private universities, including Arizona State University (ASU), University of Arizona (U of A), Embry-Riddle Aeronautical University and Grand Canyon University (GCU), offer programs preparing students for aerospace & defense fields. With competitive non-distance program completions at colleges and universities in the concentrations of Aerospace Engineering, Mechanical Engineering, Industrial Engineering, Software Engineering, Electrical Engineering, Aviation, Physics and Space Sciences, and more that directly support the growing A&D industry.

K-12 STEM Initiatives

The Arizona STEM Network, led by the Science Foundation of Arizona, leads a number of initiatives and brings together educators of all levels to improve STEM education in the state’s K-12 system and upgrade the quality of the talent pipeline in the long term. Among these is the HELIOS STEM Schools pilot program that develops a system to provide the infrastructure, resources and metrics needed to improve educational outcomes in STEM fields.

Greater Phoenix A&D Talent Pipeline

Below are total numbers of non-distance program completions at Greater Phoenix colleges and universities for programs relevant to aerospace and defense. The region produced over 4,000 graduates in these fields during the 2020 to 2021 school year, up 50% from the 2016 to 2017 school year. Comparison data for peer markets has been provided below.

| Certificate | Associate | Bachelor's | Master's | Doctorate |

|---|---|---|---|---|

672 |

61 |

1,895 |

1,390 |

176 |

Aerospace and Defense Related Degree Completions by Metro

Source: Lightcast 2023 Q3 Dataset

Competitive Operating Costs

Pro-Business Operating Environment

Arizona offers a minimalist regulatory approach, no corporate franchise tax and is constitutionally recognized as a right-to-work state. From aggressive tax credits and incentives to programs designed to increase access to capital, the region offers direct access to Arizona’s robust, pro-business climate. Greater Phoenix provides the right combination of affordability, size and scalability, making it the perfect choice for new-to-market and growing manufacturers.

Tax Incentives for A&D Operations in Greater Phoenix

- Quality Jobs Tax Credit Program – Provides tax credits to employers creating a minimum number of net new quality jobs and making a minimum capital investment in Arizona

- Foreign Trade Tax Credit Program – Designated areas where imports can be stored without full customs formalities

- Qualified Facility Tax Credit Program – Targets manufacturing facilities, including those focusing on research and development or headquarters locations

- Military Reuse Zone Tax Credit Program – Established in 1992 to minimize the impact of military base closures, both Arizona-designated MRZs are in Greater Phoenix: Mesa Gateway and Goodyear Airports

Affordable Operating & Unmatched Access

Companies like Boeing, General Dynamics, Honeywell and Lockheed Martin enjoy the state’s affordable operating environment and market advantages. From skilled labor, accessibility and market connectivity, to available buildings and shovel-ready sites, the region offers unmatched access to military and training facilities.

Annual Operating Cost by Metro

|

Metro |

Employee Payroll |

Fringe And Mandated Benefits |

Utilities |

Real Estate Payments |

Property Taxes |

Total Operating Cost |

Index |

|---|---|---|---|---|---|---|---|

Phoenix |

$13,609,927 |

$3,074,789 |

$19,698 |

$386,000 |

$9,860 |

$17,100,274 |

100.0% |

Dallas-Fort Worth |

$15,070,197 |

$3,412,854 |

$22,963 |

$303,000 |

$468,660 |

$19,277,674 |

112.7% |

Los Angeles

|

$15,822,302 |

$3,717,699 |

$24,465 |

$862,000 |

$235,800 |

$20,662,265 |

120.8% |

San Diego |

$15,216,246 |

$3,577,868 |

$42,088 |

$726,000 |

$234,200

|

$19,796,402 |

115.8% |

Seattle |

$16,282,789 |

$4,136,448 |

$15,841 |

$532,000 |

$189,907 |

$21,156,985 |

123.7% |

Wichita |

$12,878,389 |

$2,965,346 |

$16,435 |

$241,000 |

$787,885 |

$16,889,055 |

98.8% |

Assumptions: $20,000,000 personal property investment; 50,000 square foot Industrial Manufacturing, Lease; Utilities (per month): Electricity: 40W, 10,000KWh, Water/Wastewater: 3,000cf, 5/8 meter; 150 jobs (Bureau of Labor Statistics equivalent occupations)

Download the full industry analysis for more on Greater Phoenix operating costs.

Reliable Infrastructure

Powering Aerospace & Defense

Arizona has the second-most reliable power grid in the nation and 73% fewer natural disasters than the adjacent state of California. Over the last 10-year period, Arizona recorded only 33 total hours of disturbances. Reduce risk and increase operating efficiency moving to Greater Phoenix.

Photo Credit: SRP

Grid System

Greater Phoenix came of age in the era of the automobile, meaning the street system for vehicles as a grid plan with wide roads and lower levels of traffic. The region’s highways are well-planned and provide easy access to all the major submarkets in the region.

Airline Connectivity & Access

Phoenix Sky Harbor International Airpot and Mesa Gateway International Airport offer thousands of domestic flights daily while handling over 800 tons of cargo each day. These airports are ideally situated within the Southwestern U.S. to not only meet growing e-commerce and airport logistics demands in the Phoenix metropolitan area but also to serve as a direct carrier to and from consumers in Mexico and across the nation.

Regional Rail Access

Greater Phoenix is served by two major railroads, Union Pacific and BNSF. Connecting the greater Southwest region, these railroad systems offer transload and reload centers in key industrial corridors throughout Arizona and surrounding states.

Download the full industry analysis for more on Greater Phoenix infrastructure.

High Quality of Life

Greater Phoenix Living

Experience a vibrant lifestyle and diverse culture at an affordable cost of living.

Enjoy the outdoors with more than 300 days of sunshine, average temperatures of 75 degrees, convenient access to over 400 hiking trails and globally recognized sporting events. Take part in a vibrant arts and culture scene that includes prominent classical arts to public art to craft markets and a diverse range of music and cultural events. And, eat well with fresh farmers markets in every city, and globally recognized chefs and culinary experiences at your doorstep.

Calculate Your Cost of Living Savings in Greater Phoenix

Select your annual income, monthly mortgage, healthcare and grocery costs to find how much you would save with a move to Greater Phoenix.

Annual Income

Monthly Mortgage

Monthly Healthcare

Monthly Groceries

Source: C2ER 2024 Q1 Cost of Living Analysis; Zillow Research August 2024