Join the nation’s sixth-largest Finance & Insurance Cluster

Greater Phoenix is one of the top markets in the nation to locate and expand finance and insurance operations. In fact, the region’s finance and insurance cluster is the sixth-largest in the nation. Between competitive operating costs, a robust workforce and a large existing cluster, Greater Phoenix boasts the perfect environment for your financial services business.

Finance & Insurance Industry Report

Get our 27-page, in-depth report on the finance and insurance ecosystem in Greater Phoenix.

Robust Workforce

Specialized Finance & Insurance Workforce

Greater Phoenix offers a competitive work environment with a robust supply of human capital to ensure positions of all levels and in all departments of finance and insurance are filled quickly. With dedicated university programs and a large existing cluster, new to market and growing industry leaders in finance and insurance are sure to find success in the region.

Finance Leaders

Greater Phoenix has a dynamic finance cluster made up of more than 1,200 companies with almost 68,000 employees, with operations ranging from bank branches to nerve centers for many leading finance firms. To get access to the complete list, download the industry report.

| Company |

Employees |

|---|---|

Wells Fargo |

14,088 |

Bank of America |

8,839 |

American Express |

7,776 |

JP Morgan Chase |

6,898 |

Charles Schwab |

3,438 |

Discover Financial Services |

2,770 |

Vanguard |

2,712 |

Insurtech & Insurance Leaders

Greater Phoenix’s fast-growing insurance cluster is home to more than 1,000 companies providing over 55,000 jobs and is made up of critical business units for some of America’s leading companies. Provided below is a sample of the region’s largest insurance operations. To get access to the complete list, download the industry report.

| Company |

Employees |

|---|---|

State Farm Insurance |

7,719 |

UnitedHealth Group |

4,644 |

USAA |

3,963 |

Aetna Medicaid |

2,273 |

Cigna Healthcare of Arizona |

2,111 |

Blue Cross Blue Shield of Arizona |

2,051 |

Source: MAG 2021 Employer Database

67%

Greater Phoenix has 67% higher concentration of finance and insurance businesses than the national average

Source: Lightcast 2023 Q2

2900+

2,900+ students earned degrees in accounting, finance, economics, mathematics & consumer relations from universities in Greater Phoenix in 2022

Source: Lightcast

1st

In 2018, Arizona became the first state in the U.S. to launch a FinTech Sandbox program.

Download the full industry analysis for more on the finance and insurance workforce.

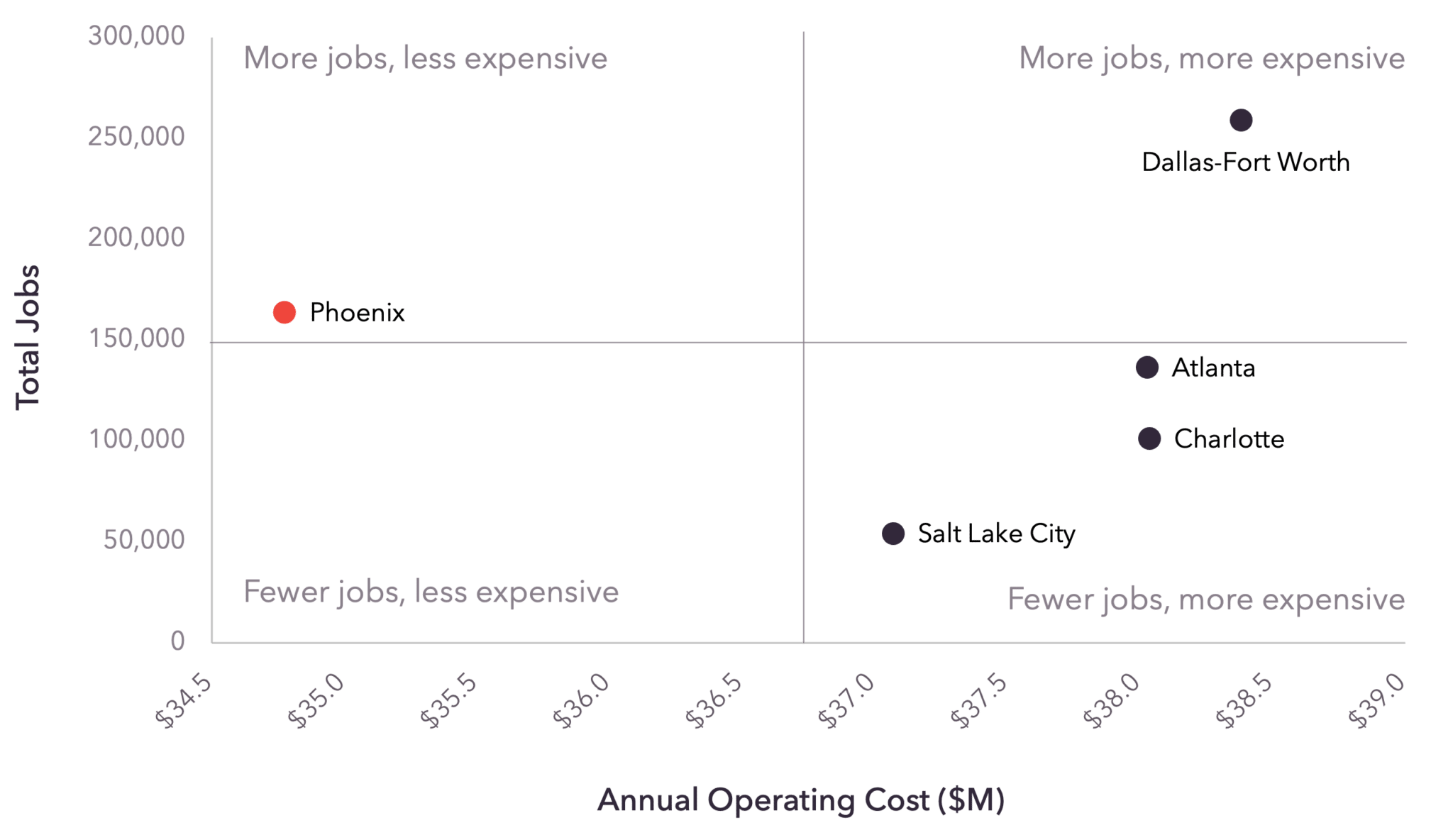

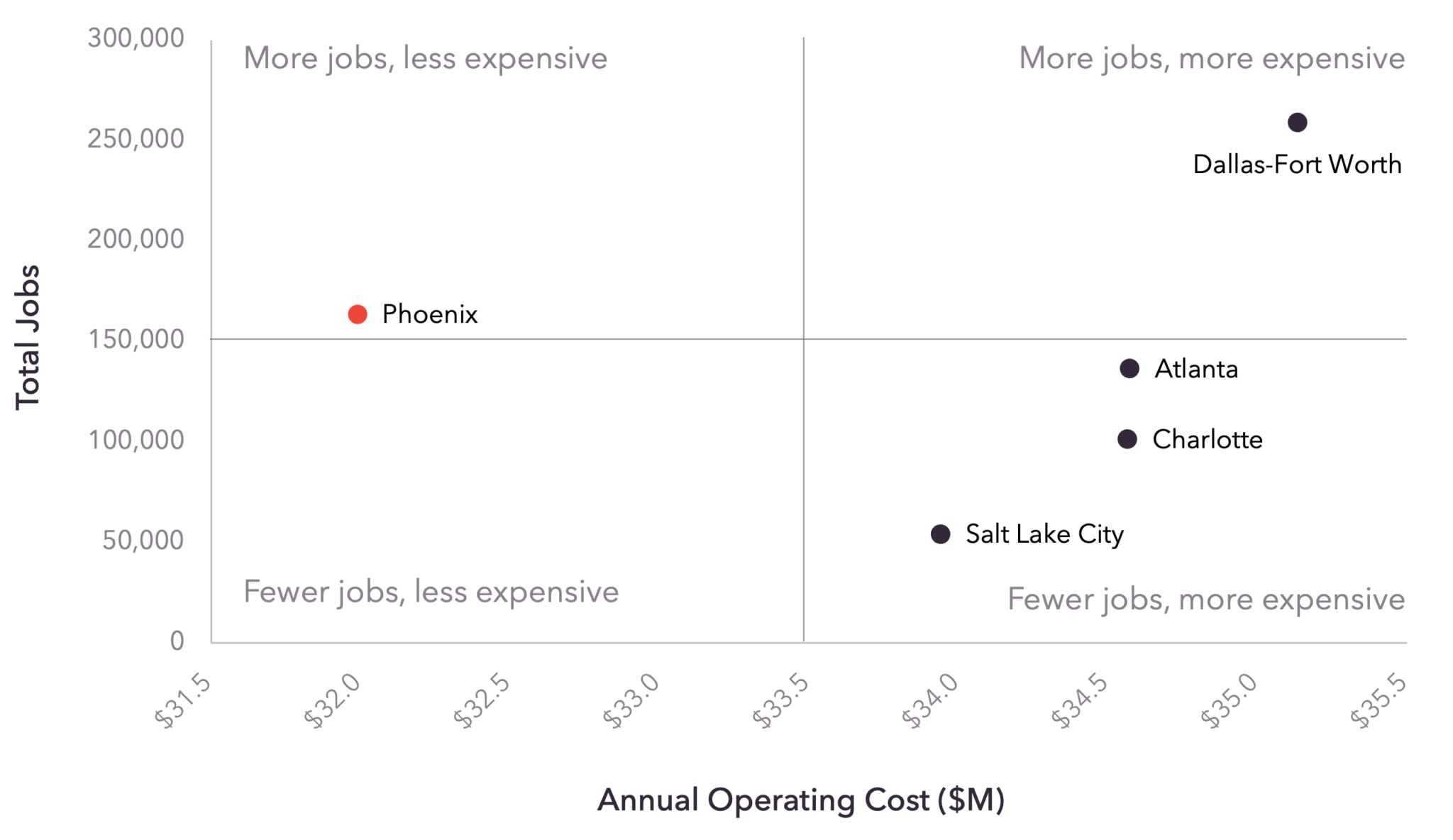

Competitive Operating Costs

Keep Costs Down in Greater Phoenix

Greater Phoenix provides a strong value proposition for finance and insurance operations, with lower operating costs and a larger labor pool than many of its peer markets. When compared to markets like Charlotte and Dallas, Greater Phoenix has significantly lower labor costs. Compared to Salt Lake City, Greater Phoenix is competitive on cost while offering a labor pool that is three times larger.

Annual Operating Cost Analysis – Finance Office

| Metro |

Payroll |

Benefits |

Real Estate |

Property Tax |

Total Operating Cost |

Index |

|---|---|---|---|---|---|---|

Phoenix |

$26,024,630 |

$5,753,599 |

$2,992,000 |

$4,930 |

$34,775,159 |

100.0% |

Atlanta |

$28,043,409 |

$6,242,499 |

$3,619,000 |

$121,880 |

$38,026,788 |

109.4% |

Charlotte |

$28,035,378 |

$6,248,962 |

$3,654,000 |

$96,500 |

$38,034,840 |

109.4% |

Dallas-Fort Worth |

$28,787,667 |

$6,392,428 |

$2,967,000 |

$234,330 |

$38,381,425 |

110.4% |

Salt Lake City |

$26,838,219 |

$6,430,850 |

$3,683,000 |

$116,380 |

$37,068,449 |

106.6% |

Annual Operating Cost Analysis – Insurance Office

| Metro |

Payroll |

Benefits |

Real Estate |

Property Tax |

Total Operating Cost |

Index |

|---|---|---|---|---|---|---|

Phoenix |

$23,739,934 |

$5,252,794 |

$2,992,000 |

$4,930 |

$31,989,658 |

100.0% |

Atlanta |

$25,210,823 |

$5,621,030 |

$3,619,000 |

$121,880 |

$34,572,733 |

108.1% |

Charlotte |

$25,190,135 |

$5,624,716 |

$3,654,000 |

$96,500 |

$34,565,351 |

108.1% |

Dallas-Fort Worth |

$26,125,113 |

$5,809,062 |

$2,967,000 |

$234,330 |

$35,135,505 |

109.8% |

Salt Lake City |

$24,272,700 |

$5,869,001 |

$3,683,000 |

$116,380 |

$33,941,081 |

106.1% |

Assumptions for finance and insurance offices: $10,000,000 personal property investment, 100,000 square foot Central Business District Office, Lease, Utilities (per month): Included in Lease, 350 jobs (Bureau of Labor Statistics equivalent occupations)

Source: Applied Economics Metrocomp Tool, July 2023

Download the industry report for a cost analysis on finance.

Exceptional Talent Pipeline

Innovative Finance and Insurance Training Programs

Arizona’s institutions of higher education are training the finance and insurance workforce of the future via innovative partnerships and high-quality programs. Whether you are a startup or are looking to relocate your finance and insurance company to Greater Phoenix, the region offers easy hiring thanks to a quality workforce pipeline while also driving additional talent to the region due to the excellent quality of life.

Arizona State University (ASU)

ASU has been named the most innovative school by U.S. News & World Report every year since 2015 and has been ranked in the top 1% of the world’s most prestigious universities by Times Higher Education. ASU has partnered with firms, institutions and organizations including the Association for Corporate Growth and National Association of Corporate Directors to produce a high-quality workforce. More than 19,000 students are enrolled in ASU’s highly regarded W.P. Carey School of Business.

University of Arizona (UArizona)

With its primary campus in Tucson, Arizona, and secondary campus in Phoenix, UArizona offers a variety of programs significant to finance and insurance employers such as finance, accounting, and management. UArizona’s highly regarded Eller College of Management enrolls more than 8,000 future professionals annually. Named the No. 4 Management Information System program by U.S. News and No. 7 MS in Cybersecurity by Cyber Degrees, UArizona provides top talent to local fintech and insurtech companies.

Large Existing Cluster

Greater Phoenix is home to a number of companies producing disruptive technology in the finance and insurance space. The region can support both startups and transplants, which has led to a number of fintech and insurtech companies moving to the region to join the numerous leading firms that have a significant presence. In addition to the largest employers listed in the workforce section, companies like the following have chosen the region:

Finance Leaders in Greater Phoenix

Insurance Leaders in Greater Phoenix

Sector Growth

GPEC has helped numerous market leaders relocate to or expand their footprint in Greater Phoenix. These six companies are among recent movers or expanders that added a total of nearly 10,000 jobs to the region since 2018.

Economic Development Programs

FinTech Sandbox

In March 2018, Arizona became the first state in the U.S. to create a Regulatory Sandbox Program (RSP) where financial services companies can test innovative products and technology in market for up to 24 months without obtaining a license or other authorizations that might otherwise be required. The sandbox encourages the development of emerging industries like fintech, blockchain and cryptocurrencies throughout the state.

More information can be found here.

Quality Jobs Tax Credit

The Quality Jobs Tax Credit program awards $9,000 of corporate income tax credits per net new hire, spread over a three-year period for qualifying companies.

8.6%

Average sales tax rate

Source: Tax Foundation, 2023

4.9%

average corporate income tax rate

Source: Tax Foundation, 2023

$0.87

workers comp. rate (per $100 payroll)

Source: Source: Tax Foundation, 2023

Download the full industry analysis for more incentives and program details.

Quality of Life

Greater Phoenix Lifestyle

Experience a vibrant lifestyle and diverse culture at an affordable cost of living.

Enjoy the outdoors with more than 300 days of sunshine, average temperatures of 75 degrees, convenient access to over 400 hiking trails and globally recognized sporting events. Take part in a vibrant arts and culture scene that includes prominent classical arts to public art to craft markets and a diverse range of music and cultural events. And, eat well with fresh farmers markets in every city, and globally recognized chefs and culinary experiences at your doorstep.

Calculate Your Cost of Living Savings in Greater Phoenix

Select your annual income, monthly mortgage, healthcare and grocery costs to find how much you would save with a move to Greater Phoenix.

Annual Income

Monthly Mortgage

Monthly Healthcare

Monthly Groceries

Source: ACCRA, Cost of Living Index 2022 Q1