Build a Healthier Business in Greater Phoenix

Greater Phoenix is regionally competitive and a national leader in the healthcare and biomedical industries. The region is a premier treatment destination and has made $3 billion in strategic investments in its emerging healthcare enterprise and research capabilities through 2021.

With a thriving startup ecosystem and funding received from the Build Back Better Regional Challenge, Greater Phoenix has laid the groundwork to be an innovative, forward-thinking healthcare hub.

Healthcare & Biomedical Industry Report

Get our 37-page, in-depth report on the healthcare and biomedical ecosystem in Greater Phoenix.

Research and Development

As a result of strategic investments, Greater Phoenix is equipped with state-of-the-art research infrastructure and facilities. Leading research and clinical institutions in Greater Phoenix are making breakthroughs in translational research and healthcare delivery innovations through strategic partnerships.

Large Collaborative Network

Leading National Research Firms

There are hundreds of healthcare and biomedical firms in Greater Phoenix. Below are a few of the largest healthcare employers in Greater Phoenix.

Nonprofit Support

Greater Phoenix nonprofits are committed to supporting innovators in the space and furthering biosciences. The Arizona Bioscience Roadmap is a collaborative, long-term strategic plan, originally commissioned by the Flinn Foundation, outlining Arizona’s goals within select areas of the biosciences through 2025.

Collaborative Innovation

In December 2021, the Economic Development Administration (EDA) named GPEC as a finalist in the $1B Build Back Better Regional Challenge, in which the region will compete to receive up to $100 million in American Rescue Plan funding with the goal to develop and scale the New Healthcare Innovation Economy in Greater Phoenix.

The New Health Innovation Economy is a partnership comprising 18 coalition members and more than 40 partner organizations from industry, local governments, education institutions, nonprofits, and foundations. This project will create an inclusive end-to-end healthcare innovation ecosystem that achieves new wealth creation opportunities across broad social, demographic, and economic groups and geographies. Healthcare in the region will shift away from traditional hospitals and clinical settings and toward seamless continuity of care in home and community settings.

30.1%

Projected employment growth in the healthcare & biomedical industries over the next decade is 30.1%, compared to 16.7% nationally.

Source: Lightcast 2020 Q1

#12

Mayo Clinic Phoenix ranks as the 12th-best hospital in the nation & 41st-best in the world.

Source: Newsweek

2500+

There are more than 2,500 active, enrolling or recruiting clinical trials in Greater Phoenix.

Source: ClinicalTrials.gov

Exceptional Talent Pipeline

Top-Tier Universities & Programs

Greater Phoenix’s education pipeline surpasses top competitors in the marketplace. Unique programs at universities that operate in the region including Creighton, Arizona State and University of Arizona attract graduate students from around the nation.

Program Alignment

Arizona’s institutions of higher education are training the healthcare and biomedical workforce of the future via innovative partnerships and high-quality programs with clinics and hospitals around the region.

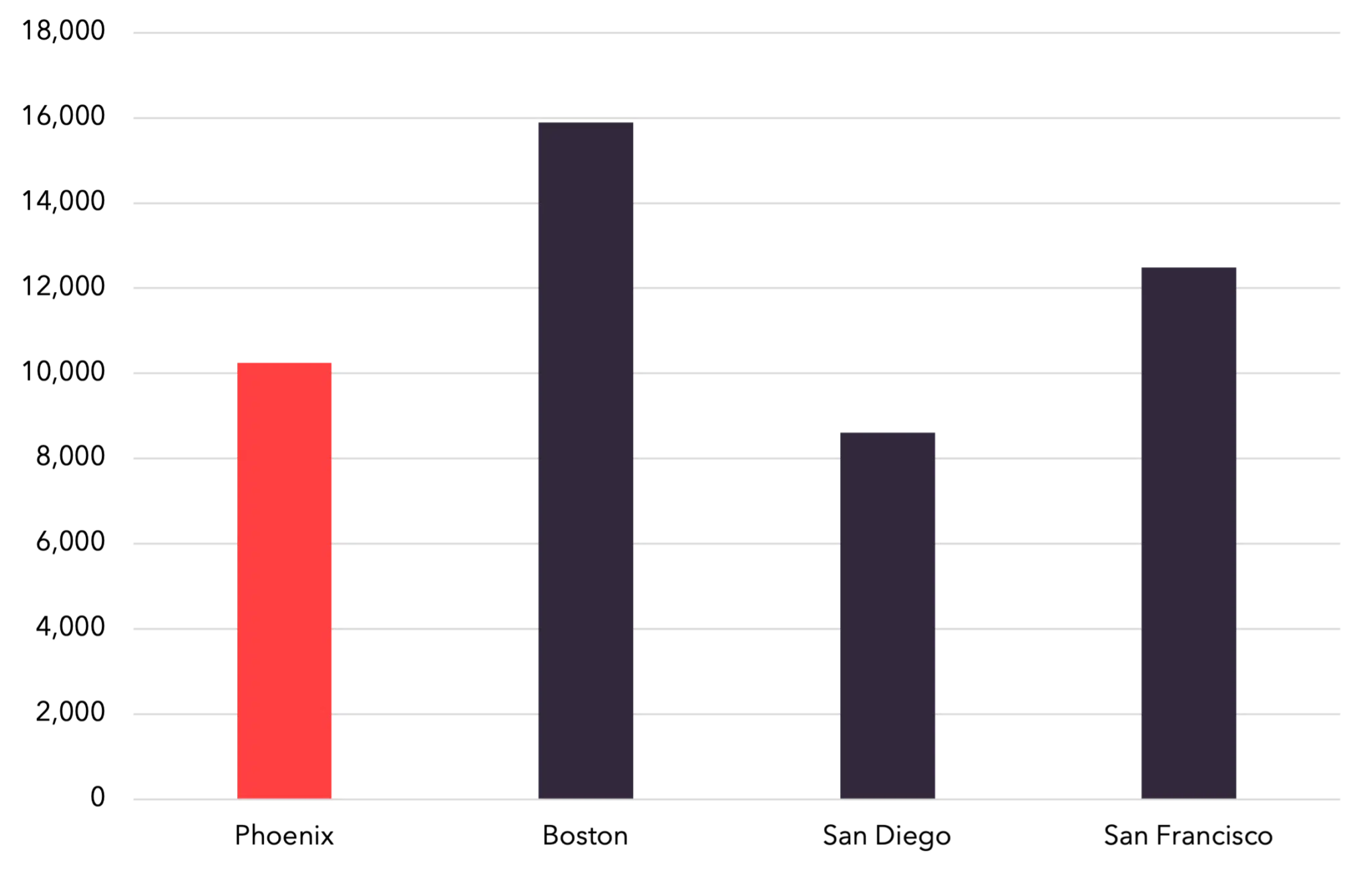

Competitor Market Talent Pipeline

Source: Lightcast 2022 Q1 Dataset

Download the full industry analysis for more on the network and pipeline.

Research and Development

Phoenix Bioscience Hubs

Discovery Oasis

North Phoenix

Discovery Oasis is a 120-acre medical and research campus with 3.3 million square feet of facilities, created for the entire ecosystem of biomedical innovators and home to Mayo Clinic and ASU Health Futures.

Phoenix Medical Quarter

Midtown Phoenix

Announced in April of 2023, the Phoenix Medical Quarter is a bio-innovation district anchored by Creighton University, Barrow Neurological Institute and Phoenix Children’s Hospital, in and around Park Central.

Phoenix Bioscience Core (PBC)

Downtown Phoenix

A 30-acre academic and scientific research campus with anchor universities including University of Arizona, Arizona State University and Northern Arizona University, PBC has 6 million square feet planned for full build out.

Biomedical Research in the Heart of Greater Phoenix

The highest concentration of research scientists and complementary research professionals in the region is currently in downtown Phoenix at the Phoenix Bioscience Core. Firms and researchers have unprecedented opportunities to operate and grow at PBC, currently developed to 1.5 million square feet with plans to grow to more than 6 million square feet of biomedical-related research, academic and clinical facilities.

Twenty-six different entities operate at PBC, including BacVax, Center for Entrepreneurial Innovation, Dignity Health, TGen, Wexford Science + Technology, and several from ASU and UArizona. The bioscience core serves as a forum for collaboration between entrepreneurs, with Venture Cafe Phoenix operations and unique programming such as the Artist + Researcher Exhibition through the PBC Arts Committee.

Healthcare and Research at Scottsdale Cure Corridor

The Scottsdale Cure Corridor is a concept designed to promote the innovative activities around the concentration of the Bio-Life Sciences sector from Shea Boulevard to the Scottsdale Airpark. With a concentration of cutting-edge research, clinical trial activity and world class patient care delivery, the Scottsdale Cure Corridor is a foundation of the region’s innovation.

Healthcare Research and Innovation at Midwestern University

Glendale Midwestern University, located in the West Valley, is on the cutting edge of a variety of healthcare research. Its vision to expand the collaborative research network and build an institutional research investment based on its multidisciplinary team investigators in nanoscience and nanomaterials has been displayed in the growth of its Nanomedicine Center of Excellence in Translational Cancer Research and its training offered to students in fields such as pharmacy, biomedical Science, osteopathic medicine, dental medicine and veterinary medicine.

Avondale Health-Tech Corridor

Avondale Health-Tech Corridor is a growing center for specialty healthcare and technology organizations in the West Valley. The eight square-mile center, which houses over 390 companies and 8,550 employees, is home to several medical providers and researchers including City of Hope, Abrazo West, AKOS Medical Campus, BioLife, Banner Estrella, and Phoenix Children’s Southwest Specialty and Urgent Care.

Photo credit: Avondale EDGE

Robust Workforce

Healthcare Workforce in Greater Phoenix

Phoenix is expected to add 88,000 healthcare jobs in the next decade — more than healthcare innovation and biomedical hubs such as Minneapolis, San Francisco and Seattle. The region offers a skilled, diverse workforce that is continuously fueled by globally recognized universities and community colleges. Institutions that prepare highly qualified graduates for in-demand disciplines within the healthcare and bioscience industries include A.T. Still University, Arizona State University, Creighton, Grand Canyon University, Maricopa Community Colleges, Midwestern University, Northern Arizona University and the University of Arizona.

Source: Lightcast 2020 Q1

Below are a few sample occupations compared across major metros.

| Occupation |

Phoenix |

Boston |

San Diego |

San Francisco |

|---|---|---|---|---|

Registered Nurse |

38,742 |

64,654 |

25,311 |

40,519 |

Software Developers and Software Quality Assurance Analysts and Testers |

26,709 |

53,455 |

19,661 |

62,095 |

Clinical Laboratory Technologists and Technicians |

6,983 |

9,178 |

3,027 |

4,476 |

Medical and Health Services Managers |

6,010 |

12,617 |

4,003 |

6,844 |

Medical Dosimetrists, Medical Records Specialists, and Health Technologists and Technicians |

5,100 |

5,375 |

3,588 |

4,300 |

Physical Therapists |

2,736 |

5,209 |

1,794 |

3,280 |

Computer Hardware Engineers |

1,550 |

2,099 |

1,088 |

2,163 |

Healthcare Support Workers, All Other |

1,508 |

1,411 |

1,274 |

1,187 |

Medical Transcriptionists |

1,156 |

516 |

217 |

189 |

Health Information Technologists, Medical Registrars, Surgical Assistants, and Healthcare Practitioners and Technical Workers |

1,147 |

1,271 |

1,164 |

862 |

Total |

95,020 |

193,111 |

78,086 |

151,052 |

Download the full industry analysis for more on the Greater Phoenix workforce.

Local Innovation

Phoenix-Based Health Tech Startups

Greater Phoenix has more than 140 healthcare startups. Listed below are three examples of the type of innovative companies growing in the region.

Venture Capital Funding

In 2021, funding in the health and wellness sector in Greater Phoenix grew 33% year-over-year for a total of $232.6M invested in 40 local innovations. Below are some of the companies that closed on notable rounds since the start of 2021.

AZ Innovation Challenge Winners

Each year, the Arizona Commerce Authority hosts the Arizona Innovation Challenge, which awards $3 million in total to winners. That’s the largest available amount for any challenge of its kind in the country. Below is a list of winners from the healthcare and biomedical industry in Greater Phoenix from 2019 to 2021.

| Company | Winning Year | Description |

|---|---|---|

2021 |

Offers personalized concierge nursing service that provides qualified, on-demand nursing at home. |

|

2021 |

Standardizing new medical training through physical products, new methods of assessment and credentialing, and an online platform. |

|

2021 |

Developing Hespiro, a respiratory assist device that delivers a mixture of heliox and oxygen. |

|

2021 |

Produced AI care management platform for people with Alzheimer’s and mental illness. |

|

2021 |

Performs lateral patient transfers through the use of its SimPull product. |

|

2020 |

Drives neonatal care beyond the traditional hospital setting to treat for jaundice and other neonatal conditions in the home. |

|

2020 |

Performs real-time microbial monitoring. |

|

2019 |

Manufacturers Surface Plasmon Resonance (SPR) instruments for the research community, including the first commercial SPR Microscopy. |

|

2019 |

Electric toothbrush designed specifically to address the increasing incidence rate of ventilator acquired pneumonia (VAP) within hospitals and acute care facilities. |

|

2019 |

Discovers and develops medicines that regain control of genes hijacked by cancer that drive therapeutic resistance and cancer relapses. Primary cancer treatments that also make the effect of existing therapies more durable. |

|

2019 |

Phoenix-based medical device company focused on using additive manufacturing to address unmet surgeon needs. |

|

2019 |

Scottsdale-based startup using artificial intelligence and augmented reality to automate visits to the doctor’s office through kiosks. |

|

2019 |

Scottsdale-based chronic care management program for seniors with Medicare, delivered through Alexa. |

Quality of Life

Experience a vibrant lifestyle and diverse culture at an affordable cost of living.

Enjoy the outdoors with more than 300 days of sunshine, average temperatures of 75 degrees, convenient access to over 400 hiking trails and globally recognized sporting events. Take part in a vibrant arts and culture scene that includes prominent classical arts to public art to craft markets and a diverse range of music and cultural events. And, eat well with fresh farmers markets in every city, and globally recognized chefs and culinary experiences at your doorstep. Select a category of interest to learn more about Greater Phoenix living.

Calculate your savings

Select your annual income, monthly mortgage, healthcare and grocery costs to find how much you would save with a move to Greater Phoenix.

Annual Income

Monthly Mortgage

Monthly Healthcare

Monthly Groceries

Source: ACCRA, Cost of Living Index 2022 Q1