Quarterly Insights on Capital Trends

Greater Phoenix’s venture capital (VC) landscape has seen massive growth over the last five years. Each quarter we’re releasing new insights and updates on the capital trends in our market. This page will be your go-to destination for the latest trends in this region’s thriving venture capital market. Sign up to receive email updates when new insights drop.

Stay updated on new releases

$723.5M

Greater Phoenix 2023 VC funding, Q1-2

Source: Crunchbase. Funding rounds include Angel, Pre-Seed, Seed, Series Unknown, Series A & beyond; YoY compared to same period in 2022

11%

Greater Phoenix year-over-year growth

-54%

United States year-over-year growth

Greater Phoenix VC, A to Z

Publish date: 08/28/2023

Venture capital can power a region’s economic growth. We looked into VC investment in Greater Phoenix’s local firms and compared it to three other metropolitan statistical areas (MSAs) over the last decade: a tech hub about half of Phoenix’s size (Austin), a Sun Belt competitor (Atlanta) and a comparatively small innovation powerhouse (Salt Lake City).

While Greater Phoenix historically has not pulled in as much VC funding as these metros, this trend appears to be changing. The region stands out in its steady funding growth, leading the group of comparison MSAs with 38% average annual VC funding growth between 2012 and 2022. To ensure Greater Phoenix’s lead was not driven by outlier years, we checked median annual growth as well and found Greater Phoenix on top again, at 26%.

Average Annual Growth of VC Funding, 2012-2022

|

Phoenix |

Austin |

Atlanta |

Salt Lake City |

|---|---|---|---|

38% |

25% |

24% |

20% |

Digging Deeper

Another strength of the region’s venture ecosystem is its growing resilience. VC funding in Greater Phoenix has seen an 11% increase in the first half of 2023, year-over-year. This stands in stark contrast to the national trend, where year-over-year VC funding growth has plummeted by 54%. Among our comparison metros, Atlanta is down 55%, Austin is down 54% and Salt Lake City is down 42%. Greater Phoenix even weathered the capital drought of 2022 relatively well, with total VC funding to the region decreasing by 23% between 2021 and 2022 compared to a 37% drop nationally.

The relative health of Greater Phoenix’s VC funding in 2023 so far is due in large part to a massive $500 million venture round for Lessen, a proptech company based out of Scottsdale. Lessen is a homegrown startup whose success is a textbook example of the ecosystem’s early-stage investments paying off. Over the last decade in Greater Phoenix, early-stage funding rounds (angel, pre-seed and seed investments) have constituted a larger portion of total funding rounds each year compared to the other metros in our study group. As more of these early-stage companies secure follow-on funding, Greater Phoenix is set to experience growing prominence as a capital market.

#51

Greater Phoenix 2023 VC deal count, Q1-2

$14.2M

Greater Phoenix 2023 average VC deal size, Q1-2

Industry Specialties

We delved into Crunchbase’s industry descriptions for early- and late-stage funding rounds between 2012-2022, comparing them to the U.S. dataset. Greater Phoenix’s most funded categories mirrored the national trends, with healthcare and information technology companies taking the lead.

Which industries get funded?

What sets Greater Phoenix apart is the notable frequency of funding for the proptech and smart home tech (Lessen, SmartRent) industries, surpassing the other MSAs. Additionally, regional startups in edtech or education (Parchment, Prenda) had notably high funding frequencies, outpacing the national average.

What about the semiconductor industry?

Over the last 10 years, the relative VC funding frequency for semiconductor firms in Greater Phoenix was above the national average but lower than certain competitor markets, such as Austin. With TSMC and Intel announcing $58B of investment in the last 2.5 years alone, investment in the Greater Phoenix semiconductor ecosystem is dominated by well-capitalized incumbents. But keep an eye on the space in the years to come, as these top-down capital flows may stimulate venture investment among the more than 115 semiconductor-related companies that call the region home.

Conclusion

Greater Phoenix remains a resilient and promising hub for innovative ventures. Over the past decade, Greater Phoenix’s VC investment scene has shown steady growth. Despite a down year for VC in the U.S. and similar regions in 2023, investment in Greater Phoenix companies has increased. The region has a supportive ecosystem for early-stage startups and distinguishes itself with a higher frequency of funding in the proptech and edtech industries.

The future of funding

Greater Phoenix’s upward trajectory is no accident. Intentional planning from statewide organizations and programs like StartupAZ, Arizona Innovation Challenge and Venture Madness, plus accelerators like Plug and Play, are driving the evolution of our market. Local VC funds — like PHX Ventures, AVC, Pangaea Ventures, AZ-VC and Xcellerant Ventures — that did not exist a few years ago are now thriving and deploying capital in the region.

What comes next?

We created this space to publish quarterly updates about insights and trends in Greater Phoenix’s venture capital landscape. Sign up at the top of the page to receive email updates when new insights drop.

For those unfamiliar with the world and terminology of venture capital, we recommend this explainer from CB Insights.

Source: Crunchbase

Happening in the Market

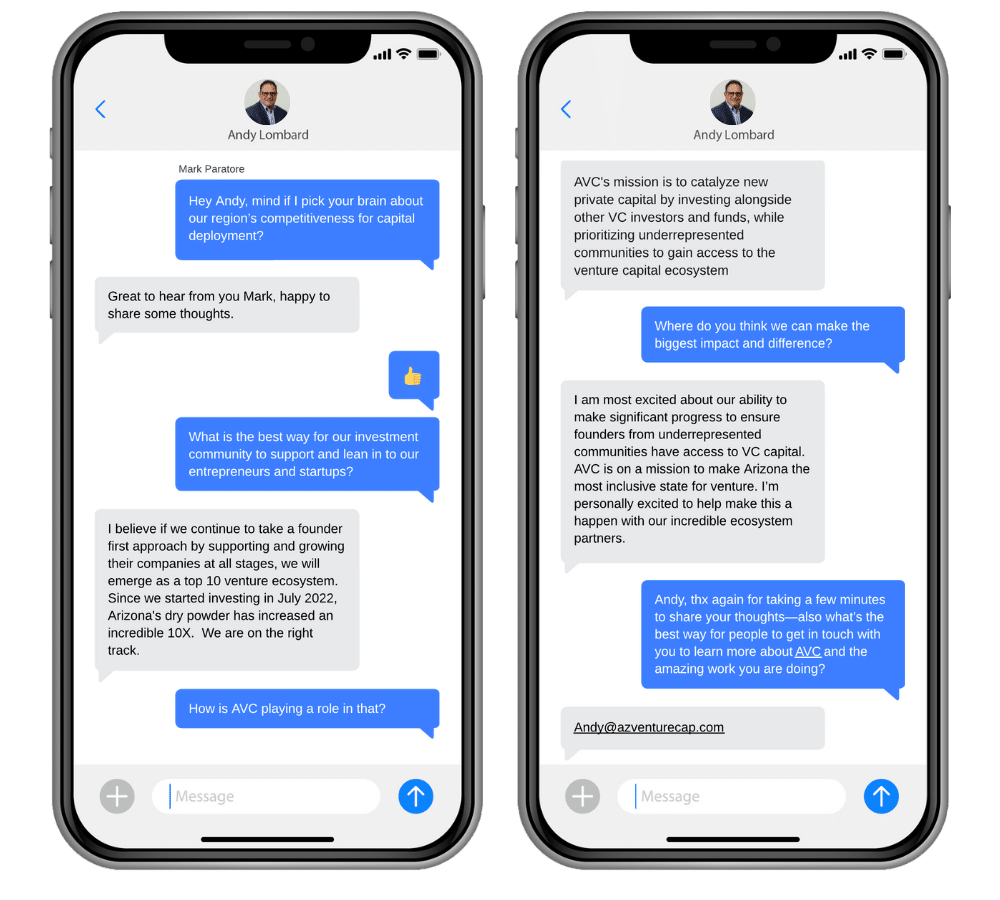

A text exchange between Mark Paratore, Vice President of Business Development at GPEC and Andy Lombard, President and CEO of Arizona Venture Development Corp (AVC)

Keep on the Lookout

Thursday Gathering: Summer of Emerging Tech

By Venture Cafe Phoenix

Every Thursday | 5:00 – 7:00 p.m.

Have a question or need more info?

We provide confidential, expert support to companies expanding or relocating to Greater Phoenix including labor/economic impact data and analytics, streamlined real estate searches and connectivity to decision makers.

Vice President, Business Development

602.262.8610 // mparatore@gpec.org

Director, Business Intelligence

602.262.8622 // kcarranza@gpec.org